Superb launch potential not reflected by the market - commercialisation upside

We upgraded Abeona Therapeutics (ABEO) to a "Buy," arguing the market has substantially undervalued the company following recent positive events. Despite the FDA's approval of its $3.1M gene therapy, ZEVASKYN, and a $152M cash injection from selling a Priority Review Voucher, the stock price has not reflected these big milestones. The analyst's conservative, risk-adjusted model calculates a fair value of at least $8.58 per share, representing a potential upside of over 36% from its current price which is expected to be realized as the company begins generating revenue.

Read our full article: “Abeona Therapeutics: Substantially Undervalued Post-FDA Approval”

Abeona Therapeutics

Excidium Research initiates coverage on Abeona Therapeutics

Nicholas Choupak , Fedor Kolchin, Asvin Pandurangi

14 April 2025

Price at publication: $4.65 (NASDAQ: ABEO)

Summary

On April 22nd, 2024, Abeona Therapeutics received a CRL from the FDA for their pz-cel (prademagene zamikeracel) BLA.

Shares of ABEO plunged 57% on the news, and EV assigned to pz-cel was traded down from $260mn to $88mn in just one day.

On resubmission, Abeona stock has made a recovery, now ascribing $152mn in value to pz-cel.

As the company’s second PDUFA date (April 29th, 2025) approaches, we will attempt to shed some light on what Abeona’s future could look like depending on the FDA's decision.

Introduction to Indication (RDEB - Recessive Dystrophic Epidermolysis Bullosa)

Recessive Dystrophic Epidermolysis Bullosa (RDEB) is a rare connective tissue disorder which is the result of a defective COL7A1 gene, leading to an inability to synthesize Type VII Collagen successfully. Type VII Collagen plays an important role in anchoring the dermal and epidermal layers of skin tissue, and without it, the skin starts to break down, leading to large, chronic wounds.

DEB (Dystrophic Epidermolysis Bullosa) differentiates into DDEB (Dominant DEB) and RDEB (Recessive DEB). RDEB is the more severe form of the condition. While Pz-Cel seeks to treat RDEB and not DDEB, the current SOC is Vyjuvek which treats both types of DEB.

Estimated prevalence for DEB patients is at 1,300 (Clearview Claims Analysis 2024) of which Abeona believes 750 patients to be eligible for treatment with Pz-Cel (RDEB patients). About 20 patients with RDEB (treatment-eligible for Abeona) are born every year, but the patient population is fairly stable due to the reduced life expectancy associated with the condition.

Current Treatment Landscape:

The current best available treatment for RDEB is Vyjuvek (beremagene-geperpavec-svdt). It is a topically applied cream that uses an HSV-1 vector (Herpes Simplex Virus - 1) to deliver the functional COL7A1 gene directly into cells inside the patient’s wounds.

Vyjuvek is the only drug that brings in revenue for its proprietor, Krystal Biotech, having been approved since 2023. Krystal recently reported revenue of $290mn for the full year 2024, representing significant earnings growth, Q4 2024 up 116% compared to Q4 2023.

This lends credence to Abeona’s guidance that a preferred treatment for RDEB could represent $500mn in annual revenue or more, and Krystal has certainly provided proof of concept in terms of insurance willingness to pay, achieving these impressive growth numbers despite Vyjuvek’s price point in excess of $24k per vial, representing a cost of $630k /patient year or $15-22mn in lifetime expenses per patient (high SD due to lifespan variance). Abeona’s announced treatment “floor price” of $1.5M per patient would allow payers to cut down on this chronic cost on the RDEB side of the DEB market.

Regarding coverage distribution, 40-45% of patients have medicare/medicaid coverage with the remaining 55-60% commercially insured. Although the situation on the commercial side is less clear, CMS has issued product-specific procedure codes as well as favourable billing codes - signalling that payers are ready to accept the value proposition at the announced “floor price” of $1.5M.

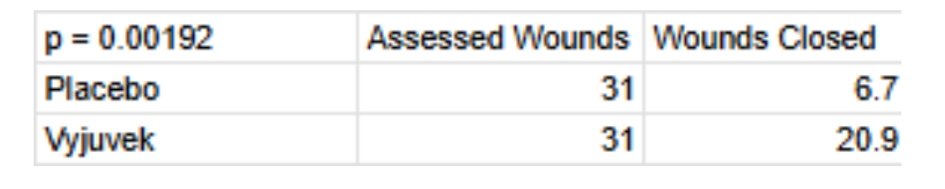

Efficacy of Vyjuvek (NCT04491604):

Shown above is the most important piece of clinical data in assessing Vyjuvek’s efficacy in treating DEB from Krystal’s Phase 3 in that indication. 31 patients were instructed to select a wound pair (controlled for size, severity etc.) , one of the two wounds on each patient would receive an inert topical gel (vehicle/placebo) and one would receive an active dose of Vyjuvek. One wound closure was defined as a 100% reduction in wound size at the 26 weeks from baseline assessment point. Vyjuvek was shown to achieve approximately 67% wound closure against 22% for placebo. Statistical significance was noted with p = 0.00192.

Does Pz-Cel demonstrate clinical superiority to Vyjuvek (NCT04227106)?

Prademagene Zamikeracel (Pz-Cel) is Abeona’s lead clinical program and is a stem cell therapy that involves proliferating the patient’s skin cells in the lab, gene-correcting them to re-introduce COL7A1, preparing sheets of this skin and surgically grafting them onto wound sites.

It is important to note that Pz-Cel is designed to be a one or two time treatment, where Vyjuvek is applied every two weeks.

Abeona’s study differed from Krystal’s in that it set its primary endpoint as “proportion of wound sites with greater than 50% healing versus placebo” rather than “100% (closure)”.

Chronologically, the endpoint was comparable, with data being collected at 24 weeks.

Abeona also had a co-primary - Pain Reduction (Associated with wound dressing change assessed by the mean differences in scores of the Wong-Baker FACES scale between treated and untreated wounds).

Another difference from the study conducted by Krystal was that instead of selecting a wound pair from each participant for the study, Abeona opted to apply (up to) 6 EB-101 (gene-corrected) sheets of autologous skin graft to the patient wound sites, analysing the data as pooled treated wound sites vs pooled untreated wound sites across the all the patients. We believe this to compromise the data quality somewhat due to the weaker study control, but it is understandable given the difficulty of enrolling patients with an extremely rare condition to attempt to maximize sample size here.

There seems to be no p-value published or statistical analysis conducted by Abeona that has been denoted in the clinical trial summary. In any case, the p value here would be <0.05.

Pz-cel also demonstrates an impressive capacity for pain reduction. Again, no listed p-value here, but given the large difference in scores we can infer that this does demonstrate clinical significance. It stands to reason that a statistical analysis undoubtedly exists, but has simply not yet been uploaded to clinicaltrials.gov. Indeed, these results are marked as incomplete.

Interestingly, there is, in fact, a third outcome measure which is a secondary endpoint called “Proportion of Randomized Wound Pairs With Complete Wound Healing”. This metric is very convenient for the purpose of facilitating direct comparison with their only major competitor, Krystal’s Vyjuvek.

At 24 weeks, the proportion of wounds Pz-Cel is able to heal compared to Vyjuvek does not seem very impressive. However it should be noted that Vyjuvek treats both DDEB and RDEB, and its trial had a mix of the two conditions. RDEB is more severe, wounds are larger and more difficult to treat. This is why there were zero wound closures in the RDEB placebo group over 24 weeks, compared to 22% in Krystal’s trial in 26 weeks. This is further supported by the average area of wound site at baseline in Krystal’s clinical trial being around 15 cm2. In Abeona’s trial, enrollment criteria required wounds of at least 20 cm2 in surface area with Pz-Cel being specified to cover wounds up to 40 cm2 in surface area.

In conclusion, Pz-Cel is likely a slightly clinically superior option for the management of RDEB, but the data is quite sparse due to the very low sample sizes characteristic of a very rare disease.

Upcoming FDA Approval?:

In Abeona’s CRL in April 2024, the FDA did not raise safety or efficacy concerns.

The only issue outlined in the CRL was a request for further CMC (Chemistry Manufacturing & Controls) data. Specifically, the FDA wanted data pertaining to validation of sterility-related assays such as comprehensive proof of post-use integrity and retention capacity of microbial filters, testing for contamination with mycoplasma or bacterial endotoxins, and insisted that Abeona adopt certain rapid sterility testing measures to accommodate for the short shelf-life of the Pz-Cel dermal sheets.

In a conference call held the day after the April 2024 CRL, the CEO of Abeona, Dr Vishwas Seshadri clarified that these requests for further CMC compliance were brought up in a late cycle review meeting on the 21st of March 2024, with Abeona suggesting plans to the FDA in an informal meeting following that on the 29th of March. Abeona told the FDA that some of the CMC data would be provided before the specified 2024 PDUFA date (in May) and the rest would be made available to the regulator following approval but before commercialisation. The FDA clearly did not find this satisfactory as in the CRL issued the following month (well ahead of the PDUFA deadline), it specified that the suggested time allotted for the FDA to review the additional data (from Vishwas’s statements we can infer, that this wouldn’t have exceeded a single month) would be insufficient and a 6-month timeline following CRL resubmission would prove more adequate.

Normally CRLs for CMC issues are relatively straightforward in scope as no further studies are required from the sponsor and a resubmission normally follows swfitly after the issues in question are addressed. The caveat here is that Abeona manufactures their own product as opposed to relying on a third-party manufacturer meaning there was an oversight on the part of management involved. Furthermore, we are currently in a volatile regulatory environment, with layoffs at the FDA becoming potentially problematic, especially with the recent resignation of Peter Marks (director of CBER, the Center for Biologics Evaluation and Research). Given that Abeona’s BLA falls under CBER’s remit, this is certainly a negative development for the company and for the biologics sector on a macro level. Normally, we would expect a BLA resubmission for a CMC issue to result in approval notwithstanding shortcomings on the part of management, but in the current environment, the decision could certainly go either way.

FDA approval case and the RDEB market

Abeona commonly cites two analyses for their estimates of the patient population. The first is Eichstadt et al. (2019) which uses a genetic model to come up with a very unreliable and ungrounded estimate for the prevalence of the patient population. However, Abeona does not rely on those estimates and typically cites a patient population of 750 patients deduced during their “Clearview claims analysis”. I have so far been unable to find a presentation, press release or other publication which details the methodology of this claims analysis.

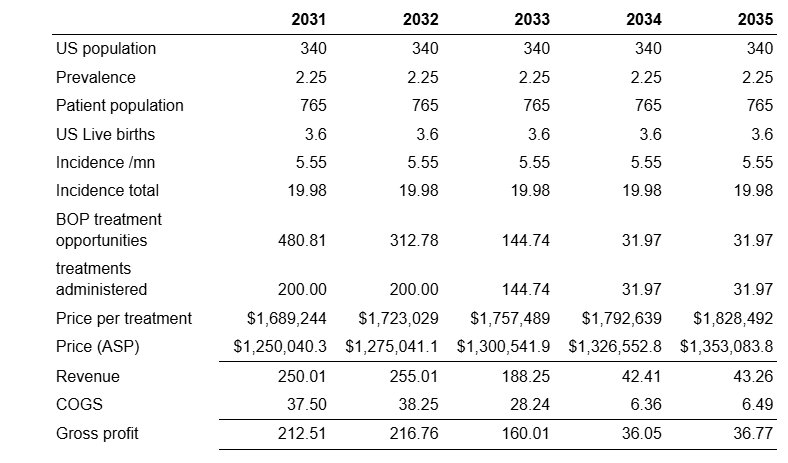

Previous epidemiological work on the disease has yielded prevalence estimates of 1.35 per million (Fine, 2016), 2.1 per million (Baardman et al), 3.3 per million (Petrof et al). These estimates were sourced from analyses of registries - the US’ National Epidermolysis Bullosa Registry (NEBR), the Dutch EB registry and NHS data. Expanding the average prevalence of these three estimates (2.25 per million) to the US population, we can estimate the patient population to be 765 people, which is more or less in line with the mysterious claims analysis conducted by Abeona. Abeona has indicated that each patient will need to receive two treatments.

An average of the three incidence (5.55) estimates associated with the aforementioned prevalence estimates scaled by the ~3.6 million live births in the US yields around 20 new patients per year added to the current pool. As a sanity check, the implied life expectancy of this incidence estimate is approximately 38 years old, which is consistent with commonly cited life expectancy. With pz-cel trialed in patients 6 years and older, a mortality adjustment is not necessary as cumulative probability of mortality for RDEB patients aged 5 years is around 0.01 (Eichstadt et al., 2019). That being said, mortality spikes from the ages of 15-20 from 0.047 to 0.158.

We assume that 80% of RDEB patients will be eligible for pz-cel. As a complex therapy, with a very high cost, this assumption is designed to accommodate complex cases, holdouts and some payer pressure. With 2 treatments per patient, we project approximately 1750 treatments administered through the lifecycle of the drug based on the outlined prevalence, incidence and eligibility parameters.

Uptake and Commercialisation

“This is going to be a supply gated uptake” - Madhav Vasanthavada, Chief Commercial Officer

The RDEB market is highly concentrated due to the rarity and severity of the disease. Abeona estimates that there are about 23 Centers of Excellence treating the majority of RDEB patients. As such, there is no need for an expensive salesforce. Abeona is currently onboarding 5 centers of excellence ahead of the potential launch, which will be able to provide 1-2 patients per month. This puts the patient demand at somewhere between 30 and 60 for the second half of 2025. In contrast, Abeona has stated that the current manufacturing capacity can accommodate roughly one patient per week, meaning that they will be able to supply only around 20-25 patients in 2025. Capacity expansions at current facilities can accommodate up 110-120 per annum while a planned capacity expansion can allow for up to 200 patients per annum. As a result, model launch as follows:

At this capacity, Abeona is able to treat the entire stock of RDEB patients by 2033, at which point only around

We include a 2% price increase, which is very conservative. Drug prices saw an average annual price increase of 5.79% over 2006-2020 (Schondelmeyer and Purvis). It is expected that the Trump administration’s future pharmaceutical tariffs will create upwards pressures on drug pricing. We assume that ASP is 74% of the list price (Matthews and Robey, 2017). Abeona’s own gross margin projections are 85%-90% and we adopt the lower end of that range.

Abeona’s patents begin to expire in 2037. Due to the high cost of development and the low steady state revenue of the indication (around 30 procedures a year) the market will not be attractive and hence we do not expect biosimilar competition. We hence allow 5 additional years of sales up to 2042. However, as Abeona is effectively able to treat the entire current stock of treatment opportunities by around 2033, revenue during these years is pretty insignificant to the firm’s valuation.

R&D and SG&A expenses.

We include R&D expenses of $5M post launch to allow the company to investigate potential Ex-US markets and to work on the remaining pipeline (although it is not particularly promising). Since there is no need for a sales force or marketing expenditure, we simply model a 50% increase in headcount at a cost of $225k per employee (Matthews and Robey, 2017). Upon reaching capacity, we increase SG&A to be 34% of revenue - the median for post-commercial biotechs (Matthews and Robey, 2017)

We hold interest expenses to be constant at 13.5% on a $13M note, which will be the only remaining note after the expiry of the ~$6M current debt tranche.This credit facility comes from Avenue Venture Opportunities, and offers up to another $30M. With the current cash level of the company, as well as this backup facility in place, there should be no need for Abeona to conduct a post-approval dilution.

The table above outlines WACC calculations for Abeona, yielding a discount rate of 10.79%.

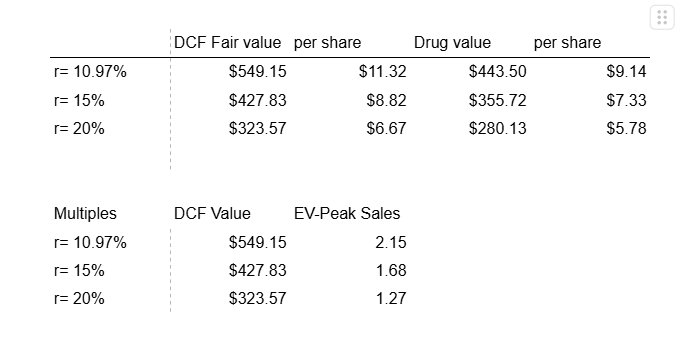

Approval cases

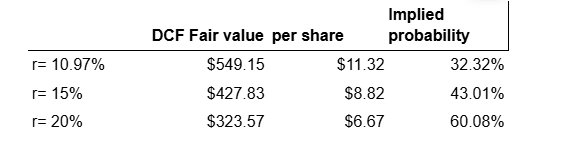

Based on this WACC, the net present value of the drug (discounting the net profit by the WACC) is $524M while the discounted cash flow (discounting UFCF) yields a fair value of $550M upon approval. At higher discount rates (15-20%), more representative of hurdle rates sometimes used for valuation in the industry, this drops to $430M-$320M.

These valuations are at much lower EV-Peak sales multiples than what are usually expected of pharma, which reflects the transient nature of the peak sales due to the curative nature of the disease eroding treatment opportunities over time.

It should be said that doubts may still remain about the company’s ability to commercialise their product quickly and effectively. Post approval, it is likely that the price could remain toward the lower end of the $6.67- $11.32 valuation range and slowly consolidate upwards (downwards) based on good (bad) commercialisation performance.

Implied probability of approval

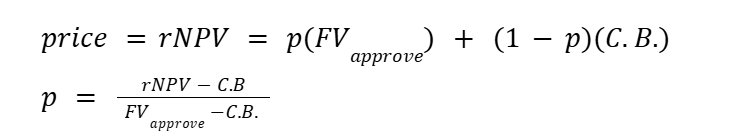

We find it is often useful to consider the implied probability of approval set by the value of the company if it is approved (previously derived DCF valuation) and the value that the company would receive if the FDA fails to approve their NDA (cash basis).

The implied probability can be characterised in the following two equations:

If we believe that the market has determined the risk adjusted net present value of the company to be $4.50, and we have determined the fair value of the company if approved and assume the company’s valuation falls to cash basis once it fails, then the only remaining variable is the implied probability, p. These implied probabilities are given in the table below.

It is important to us that you trust our work. To ensure a level of verifiability, each publication will come with a downloadable timestamp.

To check when we published a certain opinion follow the instructions:

Download the .ots file and the original pdf. You can check that the pdf contains the same content as the article.

Follow the link to opentimestamps.org

Upload the .ots file in the section titles “Stamp & Verify”

Upload the original pdf file when prompted

Wait a few moments until the timestamp is confirmed

Please note that timestamps may take up to 24 hours after publication to start working properly due to confirmation delays.