INmune Bio Inc

Excidium Research initiates coverage on INmune Bio Inc.

Ben Aubury, Nicholas Choupak , Fedor Kolchin, Asvin Pandurangi

1 March 2025

Price at publication: $8.03 (NASDAQ: INMB)

TNF-alpha inhibitors can cause widespread off-target effects and the safety profile should be closely monitored.

Data published so far has been positive but unreliable after a closer look.

INmune’s data relies on several untraditional choices made in trial design in its choice of endpoint and inclusion criteria which can impact the “approvability” of the dataset that they end up producing on XPro1595

INmune holds a currently unremarkable financial position.

INmune Bio Inc. is a clinical-stage biopharmaceutical company with a market cap of $225.3 mn with two programs - XPro, targeting mild Alzheimer’s disease (AD) by inhibiting soluble tumour necrosis factor (sTNF) and INKmune, targeting castration-resistant prostate cancer. INKmune has an ongoing Phase I study that is far from being completed. Their most relevant candidate is XPro1595 (also known as pegipanermin), a compound for its indication in AD, currently in a Phase 2 study MINDFuL. There will be a cognitive results data readout as the main catalyst in Q2 2024 after completion of the 6-month duration trial that was first dosed in early November. As a result, this analysis will be focused predominantly on the XPro program.

The inflammation theory of AD

The working theory behind the approval of drugs like lecanemab and donanemab has so far been based on the relationship between AD progression and amyloid plaque buildup, hence they have become classed as “amyloid drugs”. These drugs have fairly moderate efficacy, working to slow down AD progression by around 30%. At the same time, they have been shown to carry risk of brain swelling (ARIA-E) and microhemorrhage (ARIA-H), which is experienced by around 10-30% of the patients. The incidence of these side effects contributed in large part to Biogen’s decision to pull aducanumab from the market. In short, the amyloid theory has several well-known drawbacks that are causing a lot of discomfort and need for the development of a better treatment approach. INMune is pursuing the “inflammation theory”, which is quite a novel and interesting theory.

The pathophysiology of AD can be explained much better using the inflammation theory. Rheumatoid arthritis (RA) patients have a much higher rate of developing AD compared to the healthy population. This holds true in other autoimmune conditions such as asthma. However, a patient with RA who are on TNF inhibitors do not show an increased risk of developing AD over the normal populations, and may actually have decreased risks of developing AD.

This correlation implies an interesting link between chronic inflammation, and especially autoimmune related inflammation and the development of AD. Of course, this can be caused by other factors such as patients with those conditions being less able to exercise or socialise, which are considered protective factors against the development of AD. However, taking into account all the evidence available to us, we do believe that neuroinflammation plays a key-role in the development of AD

According to this perspective, prolonged activation of the brain’s immune cells, particularly microglia and astrocytes, leads to an excessive release of inflammatory cytokines. This sustained inflammatory state creates a neurotoxic environment that not only damages neurons directly but also impairs their ability to clear out harmful substances, including amyloid plaques.

From this viewpoint, amyloid deposits may not be the root cause but rather a by-product or even a protective response to underlying inflammation. Thus, targeting the inflammatory pathways could address the disease more effectively while potentially minimizing devastating side effects like that are associated with amyloid-targeting drugs. INMune’s approach leverages this theory by focusing on modulating the immune response, aiming to restore a healthy balance within the brain’s microenvironment and slow the progression of neurodegeneration with a more favourable safety profile.

XPro mechanistic

XPro1595 selectively neutralises soluble Tumour Necrosis Factor (sTNF) intending to reduce neuroinflammation. TNF (Tumor Necrosis Factor) has alpha and beta variants. The alpha variant has a further two variants; soluble and transmembrane. Additionally, TNF has two types of receptors, TNFR1 and TNFR2. Both soluble and transmembrane TNF-alpha can bind these receptors, however, soluble TNF-alpha binds TNFR1 with higher affinity and transmembrane TNF-alpha binds TNFR2 with higher affinity.

It is widely acknowledged that TNF is a pleiotropic cytokine, and thus interfering with its function can cause widespread and unanticipated physiological issues and other off-target effects, as has been demonstrated with other TNF inhibitors such as etanercept. This means that any clinical trial involving TNF inhibition is highly scrutinised for safety.

The proposed mechanism of XPro1595 is that it forms heterotrimers with native soluble TNF-alpha (Steed et al., 2003). This prevents the binding of TNF-alpha to its primary target: TNFR1. In theory, this would selectively inhibit any side effects of TNFR1 stimulation, which mediates neuroinflammation amongst other sequelae. Additionally, it was shown that non-selective inhibition of TNF-alpha by a chemical such as etanercept resu No lts in detrimental effects in mice such as suppressed hippocampal neurogenesis (Yli-Karjanmaa et al., 2019). This is because TNFR1 and TNFR2 mediate different physiological mechanisms, with TNFR2 having a greater impact on myelination. Nonetheless, the full scope of soluble TNF-alpha selective inhibition side effects are yet to be elucidated.

Clinical Analysis

The trial data so far is limited but has a few issues. Firstly, preclinical data of XPro1595 was gathered in murine models, which is in our opinion not super illuminating for AD pathology. Murine models will obviously have a different physiology as compared to a human model, but the difference is especially potent for AD - a striking example of this is the fact that induced mild AD in mice is amyloid plaque negative, meanwhile much of recent AD literature has focused on the role of amyloid plaque. This makes it difficult to compare effects in mice to our current understanding of the AD pathology in human models. Furthermore, the injections of XPro1595 were done intra-hippocampally as compared to the human model which will be sub-cutaneous injection. This raises questions about the permeability of XPro1595 to the blood-brain barrier and whether an increased concentration of XPro1595 (which will be necessary for subcutaneous injection for trivial reasons) will result in a greater number of adverse effects. This makes the preclinical data almost irrelevant.

INmune conducted a Phase 1B trial which enrolled a modest number of participants (n=20). The results headlined as positive: Thomas Shrader with BTIG said in a May 2021 model update on INmune Bio “despite the small size, essentially every biomarker of CNS inflammation was reduced”. However, looking at the data closer there were some notable issues. Firstly, of the 20 enrolled, 11 dropped out - leaving only 9 evaluable patients. It is also clear that much of the data available on XPro1595, from the preclinical to Phase 2 is often in novel metrics selected in their studies. For example, this Phase 1 trial involved a metric called “white matter free water” which Dr CJ Barnum described as “new to many”. Next, metrics such as cortical disarray for the grey matter quality and “MRI as a marker” are unusual according to Dr Maxime Descote. The cortical disarray measurement has a speculative level of significance. This is shown in the Fig. 1

Fig. 1 A slide taken from the Jan 21 2021 KOL webinar showing Cortical Disarray Measurement (CDM). A threshold of 5% is close to the 6% result over a nine-month duration.

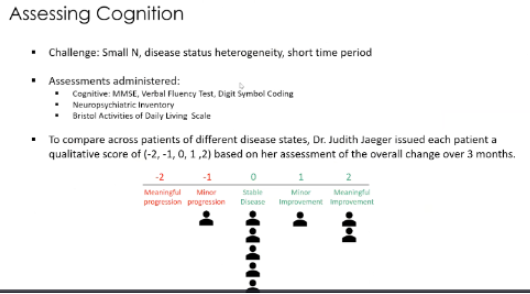

Fig 2: Another slide taken from the Jan 21 2021 KOL webinar showing patients measured on “a qualitative score based on [Dr Judith Jaeger’s] assessment of the overall change over 3 months”

The above slide depicts a cognition assessment using a single person’s qualitative opinion. It should be clear that the use of a highly subjective scale as demonstrated in Fig.2 is meaningless and should not be included in data presentations.

These new and novel metrics, along with EMACC being used in their Phase 2 may present difficulties for INMB in advancing the drug’s validity due to the FDA’s tendency to emphasize traditional metrics. The company states that EMACC allows them to shorten the trial duration as it is more sensitive to changes in cognition, hence justifying the 6-month trial duration of their Phase 2. It is possible that INmune selectively targets these novel metrics to sweeten the presentation of their data.

The study also found that 3 of the 6 patients in the 1mg/kg group wished to continue into an extension of 9 months from the 12-week dosing period. Given that out of 9 patients, 8 observed either no progression of disease or improvement, as is illustrated in Fig 2 - It is strange to see only 3 patients making this choice. Although this is something to note, it should also be said that this observation relies on a small sample size of 6 patients and a subjective metric used in Fig. 2.

To summarise our review of the phase 1 data; although there are promising signs which would have justifiably warranted a Phase 2, we believe that investors should hesitate to take a position based on these results alone. The trial size is simply too small, and the data presentation overweights some new metrics that could very well have been selected post-hoc to enhance the significance.

Moving onto future results, we have the MINDFuL readout to look forward to in Q2. The primary end-point of MINDFuL is “change from baseline cognitive function after 24 weeks of therapy, measured using EMACC”. The study’s inclusion criteria take patients 50 to 85 years old, meeting the diagnostic criteria of MCI of probable AD or mild dementia. Additionally, patients are to be amyloid positive, currently literate and has a study partner who can be used to provide a third party assessment of the patient. Patients are excluded if they receive considerable help to carry out basic ADL (as this would be outside of any description of early AD).

Providing context: FDA guidance and EMACC’s role.

The most important inclusion criteria of this trial, which defines the actual stage of AD that the trial is looking at is phrased as:

To be eligible for study entry, patients must satisfy all of the following criteria:

…

Meets the diagnostic criteria of MCI of probable Alzheimer's disease (Jack et al. 2018; NIA-AA) or mild dementia as clinically described in McKhann, (2011) and corresponding to stages 3 or 4 of the revised AD staging system (Jack, 2018). (NIA-AA);

Early AD is defined as stages 1-3, with 4 strictly excluded. Whilst it makes sense that stage 1 would be excluded due to the difficulty of measuring disease progression of patients in this early stage, the exclusion of stage 2 and the inclusion of stage 4 is against the definition of Early AD. Guidance from March 2024 published guidance titled “Early Alzheimer’s Disease: Developing Drugs for Treatment. Guidance for Industry” describes stages 4, 5, and 6 as “Patients with overt dementia, progressing through mild, moderate, and severe stages. This diagnosis [of overt dementia] is made as functional impairment worsens from that seen in Stage 3. A discussion of these three disease stages is not the focus of this guidance.”

However, it is important to remind you that the MINDFuL study is a Phase 2 study and INmune does not intend to file for a BLA with MINDFuL alone. As a result, it may be the case that INmune shifts to looking at Stage 2-3 patients in phase 3 to fall into compliance with the AD guidance and this discrepancy won’t go on to affect the final dataset. It is also important to consider that Donanemab and Llecanemab trials did enroll Stage 3 and 4 patients in their trials, while targeting the stage indication as INmune. Although those trials were designed before the publication of revised guidance and would have been reviewed under the previous set of guidance.

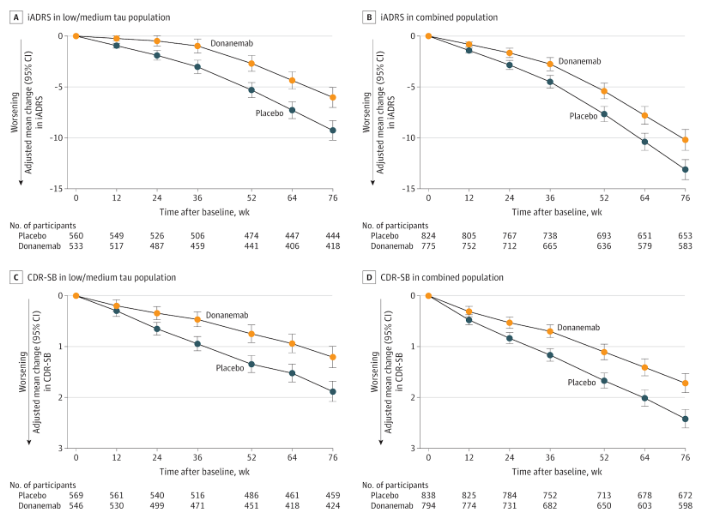

Another conflict with guidance and industry standard is the selected trial duration. Donanemab’s phase 2 (TRAILBLAZER-ALZ) and phase 3 (TRAILBLAZER-ALZ2 )were both done over 76 week study period, Lecanemab phase 2’s (NCT01767311) primary endpoint was assessed at 12 months and additional data was collected up to 18 months, with the phase 3 (Clarity AD, NCT03887455) endpoint being a duration of 18 months. INmune argues that the industry has shifted to recognise that 18-month trial durations as unnecessary for AD trials. Perhaps this confidence is bolstered by the fact that the amyloid candidates showed promising separation much earlier on in the trial than 18 months.

Fig. 3 Lecanemab Phase 3 results chart for CDR-SB. The error bars initially separated at 6 months.

Fig. 4 Donanemab Phase 3 results chart for CDR-SB. The error bars initially separated at 6 months.

However, it is important to remind ourselves that the mechanism for XPro1595 and the amyloid candidates are not similar. XPro1595 could have a slower (or faster) acting mechanism than Donanemab or Lecanemab. Additionally, MINDFuL enrolled only 200 people - whereas Fig 3 and 4 show results for studies on Donanemab and Lecanemab with 1700 + participants.

The shorter trial duration - which reduces the time the drug has to separate the error bars, combined with the much smaller sample size which increases the potential for error, meaning that a larger clinical change must be noted earlier in the progression for XPro1595 to meet CDR-SB. I.e. though the endpoint is the same between XPro1595 and Donanemab in this example, XPro1595 has had a higher bar set for its performance as a result of its inferior trial design.

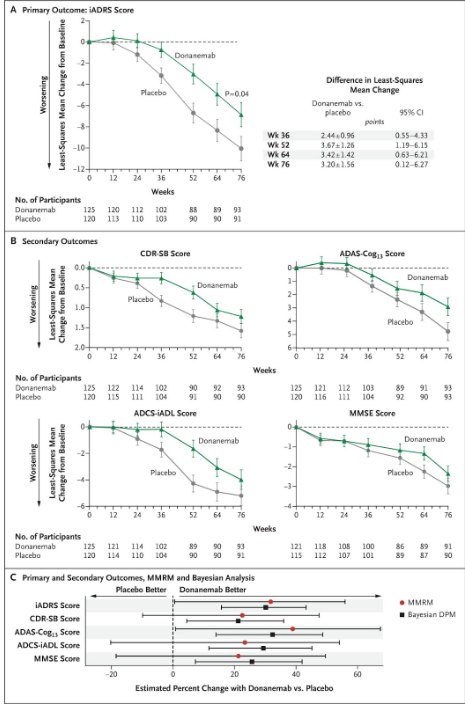

Donanemab’s TRAILBLAZER-ALZ study had a similar enrollment of approximately 200 people. When we compare the results, we can see that the error bars are notably larger. Donanemab did not have an error bar separation at 24 weeks for any primary or secondary endpoint when considering a trial with 200 people.

Fig.5 results charts from Donanemab’s TRAILBLAZER-ALZ Phase 2. This trial enrolled fewer people and the height of the error bars resultantly increased.

INmune Bio also argues that EMACC is a more sensitive measure than CDR-SB, which allows them to illustrate the small changes in progression. In theory, this would allow them to run a shorter trial duration. EMACC, standing for Early/Mild Alzheimer’s Cognitive Composite, is an endpoint that INmune Bio created. When you are rating yourself on a scale you have created for yourself, you of course have a little wiggle room in the conclusions that you reach about yourself. INmune has a strong incentive (and ability) to weight this composite measure in such a way that benefits the inclusion criteria of MINDFuL or mechanism of action of XPro1595; “the fox guards the henhouse”.

EMACC itself is not entirely an invalid endpoint. It consists of a series of cognitive assessment:

Digit Span Forward and Backward (a memory test)

International Shopping List Test (a memory test)

Category Fluency Test (DKEFS) (individuals are asked to list as many words as possible from a specific category, e.g. animals)

Letter Fluency Test (DKEFS) (individuals are asked to list as many words as possible starting with a particular letter)

Trail Making Test part A (connecting numbered circles sequentially on a page)

Trail Making Test part B (connecting numbered and lettered circles in sequence)

Digit Symbol Coding Test (match symbols to corresponding numbers based on a provided key within a time limit)

As you can see, it is an overweighted test for cognition assessment - this is more important in Early AD whilst the functional effects have not yet fully set in. Meanwhile, CDR-SB also includes many functional measures such as community affairs, engagement in home responsibilities, and personal care in addition to a panel of cognitive assessments. The absence of functional measurement, as is the case for EMACC, for drugs targetting Early AD is a topic of debate, both within the FDA and the broader clinical community. INmune has repeatedly emphasised that CDR-SB is provided as a key secondary endpoint, furthermore, the data on CDR-SB will still be presented in the phase 2 readout. However, when it comes to running phase 3 and producing a dataset for regulatory eyes, we believe that INmune Bio may make the mistake of continuing to use EMACC as their sole primary endpoint. This would fall into disagreement with FDA guidance on assessment of function as well as EMACC broadly being a less trusted metric.

Financial Analysis

Overall, INmune’s financials are not remarkable in either direction. On the one hand, they will be forced to make a dilutive offering over the next year. However, they are not threatened with immediate bankruptcy, or a negligible dilution-adjusted TAM in a post-approval scenario.

INmune last reported $33.55mn of cash on September 30th 2024. Using the same burn rate as last quarter and adjusting by the typical level of stock-based compensation, the company burns around $3.5mn per month. With 4.5 months since September 30th, we can predict that INmune has burnt roughly $15.7mn. This is in addition to the disclosed repayment of $2.5mn of debt at the beginning of this year. This leaves INmune with an estimated live cash of $15.32 mn and a runway into the end of June 2025. This means that they are forced to do an offering at the current price level. Exitus does not think that management will be able to wait until after a data readout (even assuming it is positive) to announce an offering as they don’t really have the runway to safely do this. As a result, I think we can expect an offering announcement in Q1 or Q2 of 2025. This will cause between 10 - 15 % dilution to raise $20-30mn in order to keep INmune operating. Investors likely have to buckle up for a lot of dilution going forwards as burn rate will accelerate after Q2 2025 as the company moves to a Phase 3. There are also 10,241,045 (roughly half of shares outstanding on Oct 31 2024 ) options and warrants outstanding, most of which are in-the-money at the current price level, which will be exercised either upon positive news on the Phase 2 readout or at some later point - adding to the dilution. In addition, Xencor (from which INmune licensed XPro1595) will receive a 5% royalty on Net Sales - a further addition to the dilution of the TAM attributable to current shareholders of INmune. This runs contrary to what INmune has done over the past 12 and 24 month periods: only diluting by 12% across both of those periods - which is actually on the better end of dilution for firms of their nature.

Editor’s note:

INmune Bio does not currently meet our investment criteria and as a result we do not currently have, nor intend to take on a position in the company. When we first started looking at it, we were close to taking a short position. Clearly, the data set is too immature and unclear to justify a long at this time. At the same time, their medical theory is not insane and I am glad that someone is pursuing it given that a fairly nasty class of drugs make up the current standard of care for AD. Having spoken with Jon Kulok and Harris Kupperman of Praetorian Capital, I would recommend that further research of INmune looks into the link between rheumatoid arthritis and AD, which we briefly discussed in this piece. It is possible that inmune’s next readout could provide more maturity to their dataset and will warrant additional coverage, and perhaps a position in either the long or short direction.

Fedor Kolchin

f.kolchin@lse.ac.uk

It is important to us that you trust our work. To ensure a level of verifiability, each publication will come with a downloadable timestamp.

To check when we published a certain opinion follow the instructions:

Download the .ots file and the original pdf. You can check that the pdf contains the same content as the article.

Follow the link to opentimestamps.org

Upload the .ots file in the section titles “Stamp & Verify”

Upload the original pdf file when prompted

Wait a few moments until the timestamp is confirmed

Please note that timestamps may take up to 24 hours after publication to start working properly due to confirmation delays.