A CRL, a resubmission and a dilutive offering: updating the Milestone Thesis

We maintain a bullish outlook on Milestone Pharmaceuticals (MIST) despite recent setbacks, including a Complete Response Letter (CRL) from the FDA for its drug etripamil and a subsequent, dilutive (and poorly priced) $52.5 million equity offering.

We view the CRL, which cited resolvable Chemistry, Manufacturing, and Control (CMC) issues related to nitrosamine impurities and a facility inspection, as a temporary delay rather than a fundamental flaw, noting no safety or efficacy concerns were raised.

While the equity offering has significantly reduced the potential upside by roughly half, it is partially offset by a strategic de-risking. After updating our model to account for the dilution and a delayed launch our risk-adjusted fair value for MIST is now $1.88, down from previous estimates, but still represents potential upside from the current price.

Read our full article: Milestone Pharmaceuticals Remains A Buying Opportunity Despite Recent Dilution

Excidium Research initiates a STRONG BUY recommendation on Milestone Pharmaceuticals

7 March 2025. Price at publication: $1.84

Resources:

model download Catalyst Overview:

Milestone Pharmaceuticals is a clinical-stage biotech company with a market cap of $105.59M. Their lead asset, etripamil, is a non-dihydropyridine L-type calcium channel blocker intended to be intranasally administered via a sprayed solution. They are targeting Paroxysmal Supraventricular Tachycardia (PSVT) as their primary indication, with another therapeutic pathway being explored for Atrial Fibrillation with Rapid Ventricular Rate (AFib-RVR) . Their catalyst falls on the 27th March, which will be a PDUFA regulatory decision concerning the therapeutic application of etripamil (CARDAMYST) for PSVT in the USA.

Introduction to Paroxysmal Supraventricular Tachycardia (PSVT):

PSVT describes a sudden onset of abnormal electrical activity above the ventricles, leading to an irregularly fast heart rate. It is a chronic (life-long) condition characterised by acute, highly symptomatic episodes. These “attacks” cause impaired systemic circulation, as the heart’s ability to pump blood is inhibited, which can lead to dizziness, fainting and an increased risk of stroke or heart attack.

PSVT prevalence is estimated by contemporary studies at 1.26M patients, with an annualised incidence of 189,000. The average PSVT sufferer experiences 3-5 episodes per year, though the deviation in frequency and duration of these episodes is very wide and the condition is highly variable across the population.

The condition is generally not considered life-threatening in isolation, though it does bear a significant impact on quality of life and productivity for the patient population. Episodes can last up to a few hours and leave patients in a state of fatigue often as a result of tissue hypoxia pursuant to the compromised heart rhythm and QoL stress factor of going through the attack.

Heart rhythm can regularly exceed 200 BPM in PSVT episodes which is severely distressing to the patient and often results in a visit to the emergency room, which on average costs $3-4k per visit, with 50-100,000 ER visits being made for this indication on a yearly basis in the US. This puts the cost of managing PSVT at the ER alone (not including prophylaxis & pill-in-pocket) in the US at approximately $265mn/year, with most of this cost being borne by payers.

PSVT (Current Treatment Landscape)

The current treatment landscape for PSVT can be denominated into three categories

Prophylaxis

Preventative treatments for PSVT, pharmacological prophylaxis initially consists of beta-blocker medications. Examples include Metoprolol, Atenolol, Propranolol. These medications work by slowing AV nodal conduction in an attempt to suppress the frequency and severity of attacks, but, given the persistence of ER visits in the patient population, leave much to be desired. There are also some tolerability concerns that further hurt the overall efficacy of this treatment class.

As a result, prophylactic treatment for PSVT often involves taking daily calcium channel blockers (CCBs), such as verapamil or diltiazem. Despite this, PSVT episodes can and do still occur in many patients on chronic oral CCBs, though they have a much more encouraging dataset than beta-blockers.

Acute Solutions: Verapamil (PO & IV), Diltiazem (PO), Flecainide (PO), Adenosine (IV)

Verapamil and Diltiazem are both non-dihydropyridine L-type calcium channel blockers, and follow the same MoA as etripamil - verapamil being our preferred comparison as etripamil is essentially an analogue of verapamil with an ester group attached, allowing for a shorter elimination half-life and greater solubility in blood plasma.

Fig. 1: chemical structure of etripamil, source: chemspider.com.

Fig.2: chemical structure of verapamil Source: chemspider.com.

The first line solution to an acute attack is oral medication. A “pill in the pocket” (PITP) approach, refers to the oral administration of a higher dose of the usual CCB or class IC antiarrhythmic such as flecainide that patients would normally take chronically as prophylaxis.

However, the pharmacokinetics of oral medications are not viable for acute incidents - typically acting within 45-75 mins. This means that PO verapamil, diltiazem and flecainide are not effective in preventing ER visits as patients will not see their heart rate normalise within a satisfactory period of time, even after multiple doses of the oral medication, and will resort to the ER on a predictable and consistent basis.

Upon presentation to the ER, patients experiencing RVR (Rapid Ventricular Rate) symptomatic of their PSVT are typically intravenously administered adenosine or verapamil. Meanwhile, the patient experiences a heart rate of 150 - 200bpm. While IV verapamil & Adenosine are very effective at terminating the attack of PSVT, (achieving a median conversion to sinus rhythm of <10 minutes post administration), they bear the aforementioned costly ER visit as a precondition to their success due to the regulations that govern intravenous administration of drugs.

Additionally the administration of Adenosine (which is the preferred IV option in the ER setting) is not a pleasant experience - patients commonly feel an impending sense of doom, as the heart stops briefly.

Surgical Intervention (Catheter Ablation)

A catheter ablation is a highly invasive procedure where a catheter is inserted into a blood vessel in the groin and guided via fluoroscopy to the heart. The arrhythmia is then identified, and (typically) a radiofrequency ablation is used to burn the tissue responsible for the arrhythmia.

Whilst this is generally safe, with a mortality rate of less than 0.5% and a complication incidence under 5%, it is often prohibitively expensive ($32,057 ± SD 26,737 as per Chew et al, 2024.) and can cause discomfort in many patients due to the invasive nature of the procedure.

A study funded by Milestone found that only around 17.6% of patients opt for a catheter ablation (Chew et al., 2024). Around 80,000 ablations happen annually.

Enter Etripamil:

In summation the UVP of etripamil can be phrased as the provision of the rapid conversion to sinus rhythm seen in IV verapamil to patients with PSVT without the necessity of an ER visit. Given the acute nature of attacks, by the time a patient reaches the ER to receive an IV solution, it has likely been over 30 minutes from onset of the episode. Furthermore, they have likely already taken an oral CCB that has not yet reached peak plasma concentrations.

This means that not only do these patients suffer through a long period of sustained RVR despite making every attempt to seek treatment, they also bear the cost of the ER visit and run the risk of bradycardia (dangerously slowed heart rhythm) as a consequence of taking multiple doses of oral verapamil and then receiving a further CCB IV infusion at the ER.

Etripamil offers a potential solution to all these problems, as its intranasal method of administration allows it to reach peak plasma concentrations within approx. 7 minutes.

This results in double the conversions to sinus rhythm compared against placebo at the 30 minute mark, and we can be confident in assuming that a patient who was successfully converted to base sinus rhythm will not be presenting at the ER. Its small structural variation from verapamil also allows for a shorter elimination half-life which reduces the bradycardia risk we normally see across the CCB drug class.

Clinical trial analysis (AFIB + PSVT):

Fig. 3: A summary of the available clinical data for etripamil.

NODE-1 (NCT02296190)

This study was completed on the 12th of August 2020, and Milestone publicised the results in a subsequent press release on the 30th of December 2020.

This was a small trial, and from its design, it is clear that the primary function was dose-finding, and to ensure that there were no overt toxicities associated with etripamil. To this end, though we will cover its efficacy data here, this should by no means be considered a pivotal indicator of etripamil’s efficacy in terminating PSVT episodes.

This study was conducted in patients about to undergo catheter ablation. PSVT was induced in a clinical setting by an electrophysiologist, and etripamil was administered after 5 minutes of sustained PSVT in 4 different doses, and a fifth cohort was used as control and provided with placebo. The doses were 140mg, 105mg, 70mg & 35mg.

The primary endpoint, which was met by all but the 35mg group, was to achieve a statistically significant improvement in rates of conversion to sinus rhythm, expressed as a percentage, before the 15-minute mark after study drug or placebo administration (so 20 minutes after induction of the episode).

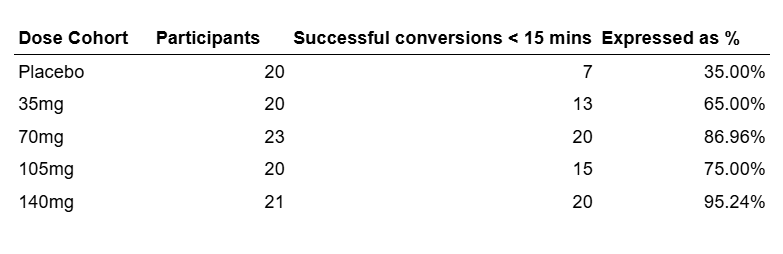

We have re-formatted the data from this trial to enhance readability, it has all been pulled from NCT02296190.

NODE-1 Efficacy Profile

The efficacy data is shown below and, although very impressive, should not be lent much weight due to its aforementioned small sample size.

Fig.4: NODE-1 conversion rates.

This data shows substantial efficacy against placebo and diminishing returns when increasing the dosage beyond 70 mg dose. The efficacy drop between 70mg and 105mg can be attributed to an artifact of the small sample size, but it is clear as to why Milestone chose to proceed with the 70 mg dose of etripamil from the lack of clear efficacy improvement at higher doses of the drug. So, though preliminary in nature, this Phase 2 shows very encouraging efficacy data for 70 mg etripamil. Thus, we can consider Milestone to have been successful in the dose-finding capacity of this study.

Fig.5: Conversion rate of induced PSVT within 15 min of drug administration. Source: Stambler et al., 2018.

We can see once again that all dosages achieved statistical significance against placebo except for 35mg and that there were diminishing returns in increasing the dosage beyond 70mg.

NODE-1 Safety Profile

The primary function of NODE-1 was to test for safety risks associated with etripamil to facilitate larger sample sizes in future studies. So this data, while small in terms of cohort size, is important to examine from a perspective of historical record for the drug as it is this safety profile that allowed for greater depth of study into the application of etripamil at a sample size that would enable FDA approval.

Shown below we have categorised the safety profile of the medication as it pertains to STEAEs (Severe Treatment Emergent Adverse Events) as we believe that the TEAEs not categorised as severe, while showing some correlation with drug dosage are limited to transient nasal discomfort or nausea, events that should be expected with a nasal spray medication and can largely be considered in line with industry standard. So the STEAEs should serve as a better benchmark to detect any potential systemic toxicities consequent to etripamil dosing.

Fig.6: Breakdown of STEAEs for the NODE-1 clinical trial.

As shown above, in NODE-1 there were only 4 STEAEs and 1 instance of Syncope in the placebo cohort, not relevant to the treatment in any capacity.

The 3 events in the 105 mg cohort were as follows

A cough which has an incidence of 1 and is unlikely to be related to the CCB MoA

Catheter Site Haematoma (can be ascribed to the following catheter ablation)

Right side Bundle Branch Block (cardiac disorder - can also be ascribed to the ablation)

In conclusion, no serious side effects were demonstrated in the NODE-1 trial, so from a safety standpoint Milestone can also be considered to have been successful in this capacity.

NODE-301 (NCT03464019)

NODE-301 was a Phase 3 Clinical Trial which was completed on the 20th of January 2023 and had an enrollment of 1097 people. To start, it should be noted that the study was divided into 3 parts:

Part 1 - Patients received etripamil until the 150th positively adjudicated PSVT episode (January 15th 2020) in a 2:1 randomisation of etripamil:placebo. The Primary endpoint of Part 1 of NODE-301 was defined as the adjudicated termination of a positively adjudicated episode of PSVT and conversion to sinus rhythm for at least 30 seconds within 5 hours.

Part 2 RAPID study - Patients that did not receive etripamil to treat PSVT before the Part 1 cutoff received a test dose of 2 70mg doses of etripamil (one at 0 minutes and one at 10 minutes) to evaluate tolerability and train patients on study procedures. After a successful test dose, the patients were randomised 1:1 to receive 70mg of etripamil at the onset of a PSVT episode and to re-administer the drug 10 minutes later should the episode persist. This part of the study continued until the 180th positively adjudicated SPVT episode.

Part 3 RAPID extension study - The design of this study was the same as Part 2 and is presented as combinant data.

The Primary endpoint of the RAPID trials was defined as the adjudicated termination of a positively adjudicated episode of PSVT and conversion to sinus rhythm for at least 30 seconds within 30 minutes of etripamil administration.

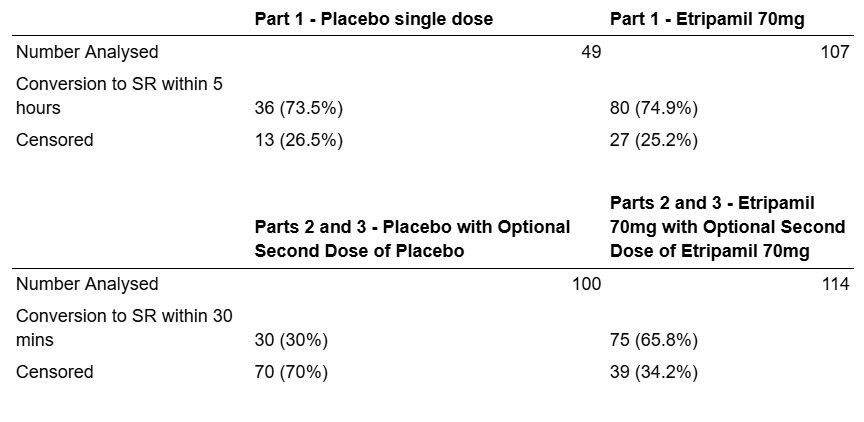

The study participant numbers have been reformatted and are shown infra.

Fig. 7: Participation breakdown for the various parts of NODE-301.

The data shown infra breaks down the patients who did not complete the trial by reason for withdrawal. From this data it is evident that patients who did not complete the trial predominantly withdrew due to No PSVT episode or for Transition to Part 2 of NODE-301. Withdrawal for reasons that can be ascribed to concerns about the study drug such as test dose failures or AEs is very limited.

Fig. 8: Reasons for study non-completion from NCT03464019

The data shown infra depicts the rates of conversion to SR within the 5-hour timeframe (Part 1) 30 minute timeframe (Part 2) as well as censored patients. The Patients are censored if they do not have a PSVT episode before the time cutoff of the study.

Fig. 9: Conversion rate to SR within 5 hours and 5 minutes from NCT03464019.

The data illustrates that the drug was significantly more effective at the 30-minute timeframe than the 5-hour time frame relative to placebo. This is because of the biomechanics of PSVT episodes, which often resolve by themselves after a longer period such as 5 hours. This is supported by the statistical analyses: The p-value for efficacy on the 5-hour timeframe was p=0.1212, whereas p<0.001 for the 30-minute time frame.

Fig. 10: Graphic depicting the conversion rate from a PSVT episode from https://www.thelancet.com/journals/lancet/article/PIIS0140-6736%2823%2900776-6/fulltext.

Shown supra, you can see the pivotal data that we believe proves the efficacy of etripamil in the PSVT indication. This is a Kaplan-Meier curve drawn from the RAPID (Part 2 NODE-301 Phase 3 Clinical Trial) of etripamil, (NCT03464019). It shows at the 30-minute mark an approximate 29% conversion to sinus rhythm for placebo, which we can compare directly against etripamil’s 67%. Placebo reaches a 67% conversion at around 90 minutes. We believe that this hour is critical in preventing ER visits, and therefore represents a commensurately critical value proposition to payer organisations as well as QoL improvements for the patient population.

The safety data from the study is shown infra:

Fig. 11: Mortality and SAE rate from NCT03464019.

The “Part 1 placebo” group experienced an episode of non-cardiac chest-pain. The “Part 1 etripamil 70mg” group experienced an intestinal obstruction. The “Part 1 Test Dose Only” group experienced 1 retinal artery occlusion, 1 acute cholecystitis incidence, 1 cellulitis incidence and 1 incisional hernia. The “Parts 2 and 3 placebo with optional second dose of placebo group” had 1 incidence of acute myocardial infarction, 1 incidence of invasive ductal breast carcinoma and 1 incidence of acute kidney injury. All of the serious adverse events experienced so far appear to be unrelated to etripamil and thus are unlikely to be treatment-caused. This is excluding the acute myocardial infarction, however, it would not be statistically significant for a couple of such instances to occur over the time frame of the study among 1100 participants given that the participants have an underlying heart condition.

In Parts 2 and 3 - etripamil 70 mg with optional second dose of etripamil 70 mg experienced 1 episode of supraventricular tachycardia and 1 episode of coronavirus infection. It is unclear whether etripamil worsened the tachycardia in this instance, whether etripamil could not fix the episode, or whether the episode occurred after taking etripamil. It is difficult to speculate on the circumstance outlined and the low frequency detracts from the necessity to investigate it further.

In Parts 2 and 3 - Test dose only (2x70mg) had the highest number and proportion of patients who experienced side-effects (18/445 = 4.04%). There was 1 episode acute myocardial infarction, 1 cardiac arrest, 2 episodes of fecaloma, 1 episode of irritable bowel syndrome, 1 episode of mesenteric panniculitis, 1 incidence of chest pain, 1 incidence of non-cardiac chest pain, 1 incidence of coronavirus, 2 incidents of coronavirus, 1 forearm fracture, 1 incidence of stage 3 colon cancer, 1 incidence of tongue neoplasm, 1 incidence of pulmonary embolism, 1 incidence of deep vein thrombosis and 3 incidents of osteoarthritis.

The proportion of patients who experienced side effects 4.04%, which is not dramatically higher than the other groups and many of these serious adverse events can be trivially discarded as non-treatment related (e.g. forearm fracture, tongue neoplasm among others).

Overall, the most notable serious adverse events were 2 incidents of acute myocardial infarction, the 1 cardiac arrest and the 1 incident of chest pain (that was not specified as non-cardiac). Therefore, 4 serious side-effects that could be considered pertinently related to the study drug occurred in the full duration of this large phase 3 clinical trial. This should be viewed as an encouraging outcome given the trial enrollment, duration and the fact that these patients will be more prone to heart conditions due to their underlying heart condition(s).

Hence, from the dataset provided in NODE-301, it seems sensible to conclude that etripamil is generally safe in its indication for PSVT.

NODE-302 (NCT03635996)

This study was originally published on the 24th of April 2023 and was a Phase 3 clinical trial for etripamil in its indication of PSVT. The Primary Outcome measure was the time to convert an episode of PSVT to Sinus Rhythm (SR) after Etripamil administration. It should be noted that the baseline number of participants was 105 which is somewhat low for a Phase 3 clinical trial for which the FDA recommends 300-3000 participants (FDA guidance on trial enrollment numbers). However, this issue is mitigated by the fact that there have been multiple phase 3 trials for Etripamil.

The design of this study was treatment in an open-label single-group assignment. This means that there was no placebo arm of the study. This differentiates it from NODE-301 in that NODE-301 had a baseline for comparison points. Additionally, the primary outcome of the study is different in that NODE-302 aims to establish a mean time to conversion from an episode of PSVT to better establish the timeframe in which etripamil works.

Within the 18-month timeframe of the study, 92/105 patients had a PSVT episode in which the median time to conversion was 21.1 minutes (95% CI 11.6 to 35.5). This number is even lower than the 30-minute timeframe established as a standard for analysis in NODE-301. This is promising news for Milestone as it showcases that the acute conversion time is potentially lower than first thought.

It is difficult to conclude the rate of adverse events due to the lack of a placebo. However, it seems sensible to draw comparisons with the placebo group of the NODE-301 study.

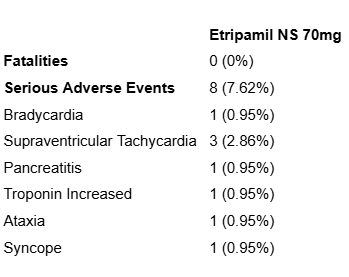

Fig 12: Serious adverse events from NODE-302.

The data shown supra illustrates a higher rate of serious adverse events than NODE-301. However, in the instance of an emergent SVT episode, it is unclear whether etripamil worsened the tachycardia in this instance, whether etripamil could not fix the episode, or whether the episode occurred after taking etripamil. It is unusual that the treatment condition is included in the list of side effects for the drug meant to address the treatment condition.

Bradycardia could be a result of the study drug being too high of a dosage for the patient’s body weight/metabolism, and as such etripamil was “too effective” in slowing the patient’s heart rate. An incidence of increased troponin is somewhat concerning, as troponin is often used as an indicator of damage to cardiomyocytes, however, it should also be considered that patients with PSVT are more likely to sustain some heart damage due to their underlying cardiomyopathy. Additionally, the syncope may be due to the drug’s effect in slowing heart rate, which could lower blood pressure and have downstream effects such as fainting. These 3 side effects seem pertinent to the safety profile of etripamil. Nonetheless, none are considerably concerning to Excidium given that 3/105 remains a low side-effect rate and other trials such as NODE-301 and NODE-303 speak to the safety of etripamil at 70mg.

NODE-303 (NCT04072835)

Abstract Summary & Introduction

The Phase 3 trial “NODE-303” is the largest clinical trial ever conducted in the PSVT indication. The trial was marked as completed by Milestone on the 10th of January 2024. Data was publicised via a press release on the 1st of April 2024. The full results were disclosed on the 23rd of May, 2024.

The study was multi-centered and open-label and was conducted to evaluate the safety of etripamil therapeutic use in PSVT acute settings. It is a safety trial only, with no efficacy endpoint.

Participants were provided with an ambulatory Cardiac Monitoring System (CMS) to help document PSVT episodes. The CMS was self-applied by the participant when they felt the onset of PSVT symptoms. Participants self-administered 70 mg etripamil NS dose if the vagal maneuver was ineffective.

It should be noted that approximately 2 years after study initiation (16 March 2021), a protocol amendment was implemented to allow participants to administer a second dose of etripamil NS 70 mg 10 minutes after the first dose if PSVT symptoms persisted. This amendment is henceforth designated “Protocol Amendment 2.1”.

Study Compliance

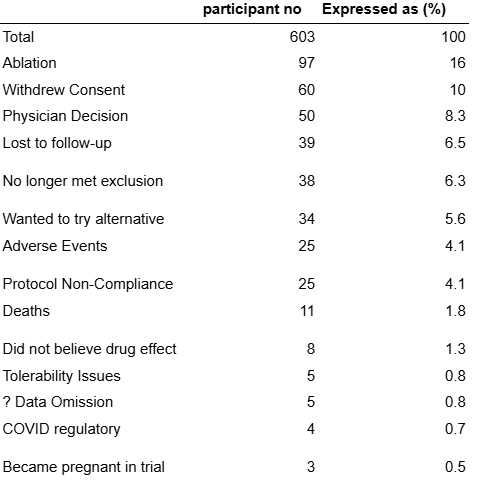

Given the size of this trial, Excidium feels it is necessary to briefly cover the enrollment/completion situation of this study.

Enrollment was 1116 patients, however, 10 patients yielded no data. Of these, 503 patients treated at least one episode of PSVT during their participation in the trial

Shown supra is the distribution of treatment instances in cohorts. The non-completion group is broken down below:

Fig. 14: Non-completion reasons in NODE-303.

The raw number of 603/1106 (54.5%) study non-completion rate appears quite alarming and initially could suggest a safety issue with Etripamil.

We believe that the above non-completion numbers can be broken down into

1 - “Implies perceived problems with the drug, anxiety about its safety, efficacy etc.” (Pertinent)

2 - “Not relevant to the drug, bears no implications to its safety, efficacy etc.” (Not Pertinent)

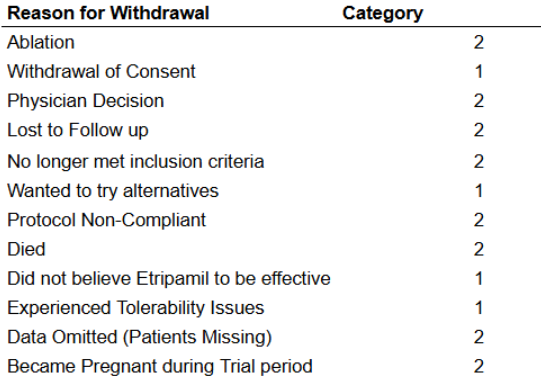

Fig. 15: Non-completion reasons categorised by pertinence in NODE-303.

If we sum the participant numbers in category 1, we obtain 107 participants who quit the trial based on anxiety about the drug’s effectiveness, tolerability issues etc. This distinction is important to make as it tells us more about how likely patients are to use the drug. Importantly, the tolerability number is low, meaning the risk of allergic reaction / other tolerance issue pursuant to test dose etripamil is about 0.45%, which is very manageable.

So our adjusted number implies that 107/1106 patients quit the trial of their own volition due to safety concerns about the drug. This is <10% and not especially elevated as completion rates in cardiology clinical trials normally range from 60-70%. While this adjusted number is helpful, it should still be noted that the very high raw non-completion here is not exactly ideal and may point to some oversights made by Milestone at the trial design level.

Outcomes & Safety Profile

NODE-303 had the primary purpose of investigating the safety of Etripamil. It had two outcome measures:

1 - Number of Participants with Adverse Events for Self-Administered Etripamil NS Outside of the Clinical Setting (Primary Endpoint)

2 - Time to convert to Sinus Rhythm up to 60 minutes after study drug administration (Secondary Endpoint)

To cover the primary endpoint first - 324 patients of the 503 who completed the trial experienced Adverse Events. (61 out of 603 for the non-treated group)

Adverse Events are differentiated into 3 types -

1 - Regular “non-serious” AEs

2 - Serious AEs

3 - All-cause mortalities

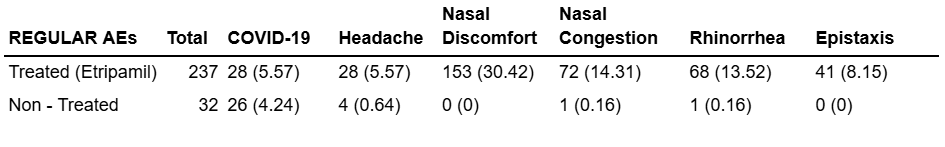

Fig 16: All adverse events in NODE-303.

Shown supra is the breakdown by severity of AEs experienced by treated and non-treated groups in this trial

Regular AEs

Fig. 17: Regular AE data breakdown from NODE-303.

As is evident from the data shown above, non-serious AEs pursuant to the ingestion of Etripamil NS are limited to nasal discomfort and congestion, rhinorrhea & epistaxis, these 4 categories account for the vast majority of non-serious AEs, notwithstanding coronavirus infections which are not statistically significant in their elevation against the non-treated group. Nasal discomfort and congestion, as well as rhinorrhea and epistaxis should not be considered concerning as they are industry standard side effects on a NS medication.

The non-serious AE category makes up 86.2% of all AEs noted in the treated cohort.

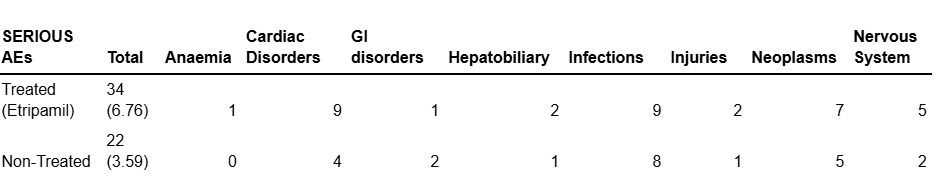

Serious AEs

We believe Serious AEs to be more pertinent to the drug’s safety profile given the mostly benign nature of the Non-Serious category.

Fig. 18: Serious AE data breakdown from NODE-303.

Shown above is a breakdown by category of STEAEs in this trial. Incidence is too low and the difference is not statistically significant in Anaemia, GI, Hepatobiliary, Infections, Injuries or in Neoplasms categories. The categories we believe to be interesting are Nervous System Disorders and Cardiac disorders, where the incidence is higher and an elevation should be noted in the etripamil-treated cohort.

Cardiac Disorders

The data on Cadiac TEAEs is interesting because the 5 patient difference between the groups is not reflected in the non-treated cohort. The etripamil cohort had 3 instances of acute myocardial infarction and 2 instances of acute coronary syndrome. The non-treated cohort had no instances of either event.

This would suggest that as a consequence of etripamil’s mechanism of action on calcium channels in the cardiomyocytes, patients could bear a low risk of cardiac disorders, which can be expressed as 5/503 = under 1%.

Nervous System Disorders

A similar situation becomes apparent in this trial concerning nervous system AEs.

The two nervous system sTEAEs in the non-treated group were Hemorrhagic Stroke and Cerebrovascular Accident.

This leads us to believe that 3 of the 5 nervous system AEs in the treated group are not due to Etripamil as they were Subarachnoid Hemorrhage, Thalamic Infarction and Transient ischemic attack.

We do not believe that these cerebrovascular AEs are consequences of etripamil as they are not substantially elevated if taken in their own separate category against the non-treated group. Furthermore, there is an absence of data that suggests etripamil acts specifically on cerebral vasculature.

However, there were 2 instances of syncope (fainting) associated with etripamil that were not reflected by any analogous AEs in the non-treated group. This does correlate with data from previous trials, for example, the NODE-1 trial. So Excidium believes that it should be noted that etripamil use does bear a small risk of fainting as an AE, with an incidence rate that can be expressed as 2/503 (0.4%). This is a consequence of etripamil’s action in slowing the heart rate, so in certain predisposed patients, it could lead to compromised circulation that leads to a brief loss of consciousness.

Efficacy Endpoint (Secondary)

Data was drawn from 231 readings successfully taken by the cardiac monitoring systems (CMSs) that the participants were equipped with at the start of the trial, and the median conversion to sinus rhythm after administration of Etripamil * was 17.7 minutes (range was 13.9 - 26.2) with a CI of 95% (p < 0.05). This data is yet more evidence of Etripamil’s efficacy in facilitating a rapid conversion to SR following an episode of PSVT. Especially notable is the range distribution which places the latest conversion at 26.2 minutes, still a substantial improvement from oral CCBs (40-60 mins) and literature figures for untreated PSVT episodes (40 - 120 mins).

* in contrast to the previous control measure of administration following 5 minutes of sustained SVT, patients were instructed to self-administer Etripamil after they felt the onset of symptoms at their own discretion, but were first asked to attempt vagal manoeuvre and to only administer if the vagal manoeuvre proved unsuccessful, so we can infer a timeline similar to 5 minutes of sustained SVT, so it is directly comparable to previous efficacy data

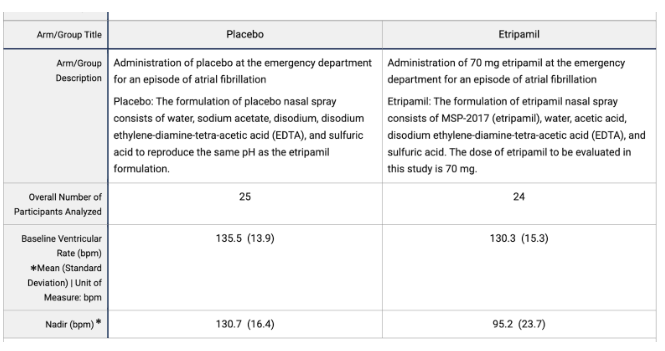

ReVeRA-201 (AFIB)

This Phase 2 Clinical Trial “ReVeRA-201” is investigating etripamil for its application in AFib (Atrial Fibrillation). AFib can lead to a rapid ventricular rate since increased (and irregular) conduction to the atrioventricular node causes an increase in the frequency of ventricular contractions. Since PSVT causes a fast and regular conduction at the AV node, the mechanisms have physiological similarities, hence it makes sense to attempt to treat AFib with etripamil.

The trial had a modest sample size (n=69), given its position as a phase II trial and that AFib is quite a common condition, affecting approximately 4.48% of the US population (source: AFib Statistics). Furthermore, NODE-1 had an enrollment of n=199, for a less frequent condition (PSVT affects approximately 0.2% of the US population PSVT statistics).

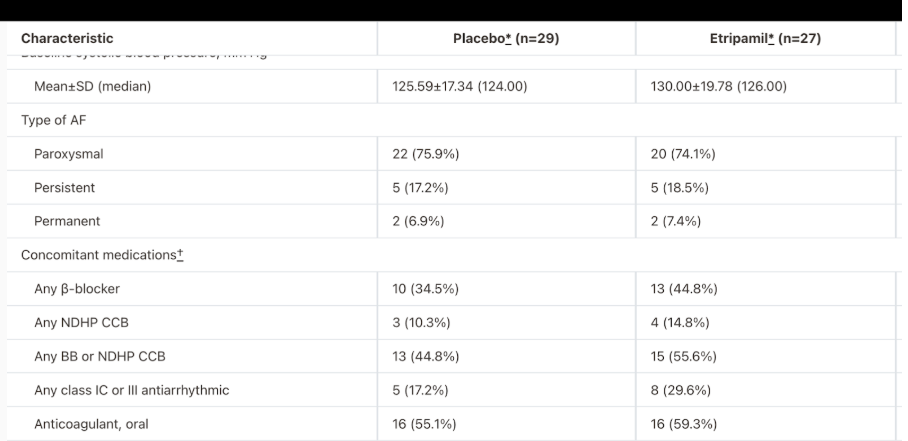

The study had 2 arms, and 56 of the original 69 patients were entered into the dosing phase of the trial. Each of the 56 patients were dosed with the 70mg etripamil spray (n=27) or the placebo (n=29) in a 1:1 randomisation. The 13 patients who did not receive a dose of etripamil nor placebo had varying but explicable reasons for non-completion. These reasons mostly arose due to the screening procedure prior to the dosing scheme in which patients were required to measure a steady heart rate <110bpm for at least 10 minutes prior by at least 6 hours to drug administration. The reasons were as follows: 5 had a baseline heart rate >110bpm, 3 experienced conversion to SR, 3 had technical issues with the Holter ECG, 1 had a hemodynamic instability and 1 had a site misinterpretation of protocol.

The primary objective of ReVeRA-201 was to demonstrate the efficacy of etripamil in reducing VR in AF-RVR within 60 minutes of treatment. This endpoint was met with an excellent p-value for reducing VR from its baseline

Fig 19: AF-RVR Reduction data from ReVeRA-201.

This data leaves us with an estimated mean difference (final values) of -29.9bpm (95% CI -40.3 to -19.3) with p<0.0001. This p-value proves extremely promising for etripamil in its application for reducing AF-RVR.

However, it should be noted that in the measured concomitant medications for Atrial Fibrillation, there was a greater medication frequency in all categories in the etripamil group as compared to placebo.

Fig. 20: Baseline data from ahajournals.com

However, this can be mitigated by the fact that the sample size is small and the trial is stated to be randomised. Additionally, it should be noted that much of etripamil’s UVP as an at-home solution to AFIB-RVR is maintained as there are currently no FDA-approved medications for acute conversion of an atrial fibrillation episode that can be self-administered. Additionally, Atrial Fibrillation has a larger target market in the US (10.55 million > 1.26 million) and is a more serious condition.

The safety profile of etripamil in ReVeRa-201 was promising. No fatalities were observed across placebo or etripamil, however, 4 patients were affected by serious adverse events in the placebo group, and 1 patient was affected in the etripamil group. The 2 serious adverse events that occurred for that patient were bradycardia and syncope. These issues could be ameliorated by a more thorough test-dosing procedure to screen for patients who do not react well to 70mg of etripamil.

CONCLUSION:

Having reviewed the studies concerning the application of etripamil, we feel that this drug is well positioned to receive FDA approval in its upcoming PDUFA regulatory decision. The safety data falls well within parameters tolerated by the FDA in cardiology therapies and the efficacy of the drug in driving conversion to sinus rhythm in the acute treatment setting has been adequately demonstrated across multiple very large datasets and patient populations. We do not see a scenario in which this data is insufficient to merit approval, notwithstanding the typical regulatory risk that is inherent to such decisions. Furthermore the non-DHP CCB MoA has been studied extensively for over 30 years in the United States and etripamil’s positioning as essentially a restructure of an existing approved and safe medication with an improved pharmacokinetic and safety profile as well as a novel method of administration lends further confidence to our position on it’s likelihood of approval.

CMC - Chemistry, Manufacturing and Controls.

In 2016, Milestone patented etripamil, and the original patent document details a small-scale, in-lab synthesis experimental of etripamil. Although the processes highlighted in this experiment might not necessarily be applicable in etripamil’s mass production, key elements of this synthesis route would remain the same after scaling up.

Analysing the etripamil experiment reveals two main weaknesses; the use of lethal KCN and questionable stereocontrol. This was criticised in Dipharma’s report on the synthetic pathway.

KCN use

Benchmarking comparison between etripamil and Verapamil does not provide insight into FDA’s regulations regarding KCN use, as Verapamil synthesis does not require the use of KCN despite the similar chemical structure. Nonetheless, the FDA has approved NDAs of drugs which used KCN as a part of their synthesis. For example:

Saxagliptin: An oral antidiabetic drug synthesized using KCN in an asymmetric Strecker reaction.

Fexofenadine: Relief of allergy symptoms such as hay fever and chronic idiopathic urticaria. In the production of fexofenadine, KCN is utilized in the formation of intermediates that eventually lead to the final active pharmaceutical ingredient.

These examples demonstrate that drugs synthesized using cyanide compounds can indeed be approved, provided they meet the safety and purity standards set by regulatory agencies. Purity, however, is an aspect of relative uncertainty. The accessible patented synthesis method is typically used in a small-scale lab, rather than an industrial setting, which would be the scenario for commercial etripamil synthesis relevant to CMC. Therefore, we cannot directly assess how well KCN is removed during synthesis by Milestone.

Regardless, we can infer two points. Firstly, KCN is relatively easy to remove. As a salt, KCN can be efficiently separated from the organic intermediate through a simple solvent extraction, using brine or water and an organic solvent for the intermediate, which would almost entirely remove KCN. Secondly, the large sample Phase 3 study of etripamil did not observe side effects related to KCN, which are headache, dizziness, confusion, anxiety, rapid breathing, and loss of consciousness upon inhalation, and nosebleed and sores in the nose when entering the nasal canal. Considering the extreme health impact and lethality of KCN (which can be fatal at doses as low as 300 mg), the study implies that KCN has been effectively removed from etripamil. Ultimately, it is Milestone’s responsibility to demonstrate to the FDA that they can safely handle and remove KCN from their products during mass production before they reach consumers.

Stereochemical considerations

Due to the similar structure of verapamil and etripamil, literature regarding stereochemistry of both compounds are reviewed.

Verapamil Patent states: ‘’Verapamil is presently in clinical use as the racemate and is used extensively for the treatment of hypertension. The opposite enantiomers of verapamil have different biological activities. The (S) -enantiomer (Levoverapamil) has the majority of the calcium channel antagonist activity (DE-A- 2059923) whilst the (R)- enantiomer (Dextroverapamil) differs in having sodium channel and other cell-pump actions in addition to higher bioavailability, with slower clearance rate. Verapamil is a known (Ca)+ channel blocker and is a competitive inhibitor of P-glycoprotein.’’

Etripamil Patent States: ‘’In certain embodiments, the compound that is dissolved in the aqueous composition is compound I (etripamil). In preferred embodiments, the compound that is dissolved in the aqueous composition is the S-enantiomer of compound I.’’ Furthermore, etripamil’s patent does not detail a purification method to remove the R-enantiomer from the S-enantiomer before dissolving the etripamil chloride salt into the final nasal spray.

Overall, etripamil does not say that a racemic mixture would be unsafe. The synthesis does not include a purification step to isolate the s-enantiomer. So etripamil is most likely a racemic mixture, with S enantiomer as the active drug and the R enantiomer as a benign contaminant.

Upon holistic review of the CMC situation and synthesis pathways for etripamil, we can conclude that CMC does not pose a serious hurdle to etripamil’s approval due to pre-existing approved drugs synthesized using KCN, satisfactory clinical trial safety data and the non-active stereoisomer being most likely benign. However we would be alarmed if the synthesis aspect is not covered in greater detail for the benefit of stakeholders before the drug actually ends up in the hands of consumers at a mass market level.

Market Analysis of Commercialisation Opportunity

The prevalence for PSVT was originally estimated to be around 570,000 patients with an incidence of 89,000 annually by Orejarena et al. in 1998, known as the MESA (Marshfield Epidemiologic Study Area) study. However, this study extrapolated a small, largely racially homogenous population to the 1990 census and as a result is quite outdated and inaccurate. It is important to note that PSVT is an underdiagnosed and frequently misdiagnosed indication, as diagnosis requires ECG evidence, which is difficult to attain given the paroxysmal and transient nature of PSVT. Increased awareness of the disease, paired with the increased prevalence of consumer fitness trackers, reduces misdiagnosis and underdiagnosis, and could result in a steady TAM growth - a potential tailwind for Milestone post-approval.

Motivated by the recognised gaps in PSVT epidemiology, Milestone has funded numerous research studies which have become the backbone of contemporary prevalence estimates. In 2021, Rehorn et al., 2021 (funded by Milestone) yielded substantially higher estimates of prevalence and incidence (at 1.26 million and 189,000, respectively). The main difference is that this study analysed insurance claims from the IBM MarketScan (previously Truven Health MarketScan) database for specific diagnostic codes for PSVT (ICD-9 code 427.0 or ICD-10 code I47.1), excluding comorbidities with Atrial Fibrillation/Flutter. At least two separate outpatient encounters, or one emergency department (ED) or inpatient encounter was necessary to qualify for classification. Using a similar approach, a separate Milestone-commissioned analysis (Sacks et al., 2019) reiterated very similar prevalence and incidence rates.

Go et al. (2018) is another Milestone-commissioned analysis which completed a review of electronic health records. Importantly, this differs from the billing code approach utilised by Sacks et al. and Rehorn et al. in the availability of diagnostic data. This allowed Go et al. to implement a case definition criteria which required ECG or physician-adjudicated PSVT diagnosis and symptom documentation. As a result, this study found prevalence in line with previous MESA estimates.

This presents a decision to be made in financial modeling. Using contemporary insurance-based estimates provides a clearer picture of PSVT prevalence by leveraging large-scale claims data, reducing the limitations of the older studies. These methods capture a broader, more representative population and mitigate underdiagnosis issues inherent to PSVT’s transient nature. The study highlights how stricter case definitions impact prevalence estimates, reinforcing the need for careful data selection. With the increasing use of consumer wearables improving detection, adopting insurance-based prevalence estimates aligns with diagnostic advancements, ensuring more accurate market projections.

As we will later demonstrate, even the 570,000 prevalence estimate will result in a very comfortable commercialisation for the company, if the newer “rational pricing” paradigm is used.

Synthetic Royalty Financing and Pricing Implications

Milestone has a synthetic royalty financing deal with their largest investor, RTW Investments - RTW agrees to pay Milestone Pharmaceuticals $75mn contingent upon etripamil’s approval in the US, in exchange Milestone pays out tranches of etripamil’s revenue to RTW pursuant to the following tiers:

7% of annual net sales up to $500mn

4% of annual net sales exceeding $500mn, until $800mn mark

1% of annual net sales exceeding $800mn

(If $500mn of net sales are not met within 12 months of approval, the royalty increases to 9.5% of net annual sales on January 1st of the following calendar year until the $500mn mark is met, at which point the contract reverts to its previous structure)

If RTW believes the company’s guidance (and we think they do, given that they own around 10% of the float, in addition to issuing $50mn convertible debt to Milestone), they can expect peak patients between 500,000-800,000 (given in the Nov 13 2023 presentation) and 5 episodes per year to yield 2,500,000 -4,000,000 annual treatable episodes. This synthetic royalty financing deal only executes upon approval of etripamil in PSVT. Therefore the following equation can be modelled:

This equation can be rearranged to find the implied price point for the commensurate sales level. For 2,500,000 annual episodes, the price required to justify the RTW investment is $85/episode, and for 4,000,000 episodes, the price is $53.35/episode. Please note that the number of treatable episodes has been adjusted to 80% of company estimates in this calculation to allow for a margin of safety for RTW. More details on our methodology can be found in the associated model published on our website. Taking the average of these two price levels, an intended price point as of can be estimated at $70/ episode as of March 2023, the signing date of this deal.

In 2019, the company suggested a price of $25-50, but given the early stage of the drug at that point we think that is a fairly inaccurate number to rely on. Whilst we think this was the previously intended price point, it seems that the price point has since shifted significantly higher.

More recently, in the Feb 25 commercialisation conference, Lorenz Muller (Chief Commercial Officer) quoted a “net sales price to us of somewhere between $500 and $1,000 per prescription”, where a prescription is defined as two 35mg doses, equivalent to a single episode. . The causes of the steady increase in pricing intention narrative could be further investigated. The various price paradigms will be investigated in separate modelling cases.

Approval scenario

Base case:

Using the previously discussed patient numbers , PSVT prevalence can be taken as 1.26 M and incidence at 189,000. With 80,000 ablations per year occurring, (ceteris paribus) the prevalence is expected to grow at approximately 109,000 patients per year. Milestone estimates in their Nov 13, 2023 presentation that TAM is approximately 40-60% of the prevalent population. All cases in our model will use the midpoint of 50% and the guided peak market share (Nov 13 presentation) of 50% for patient number assumptions. A $70 price point will be applied, adjusted for 7% royalties to yield revenue. A 2% annual price growth is factored in. We add the additional assumption that R&D costs are reduced to a negligible value of $5M annually. SG&A costs will increase by $18M relative to the trailing twelve months as a result of the additional expenses associated with a sales force of 60 non-specialty drug sales representatives costing an estimated $300k annually each (as indicated in the recent commercialisation event). Factoring in a sigmoidal commercialisation pathway, gross margins of 80%, a tax rate of 20% and a discount rate of 9.37% (using Damodaran’s Cost of Capital by Industry Sector, 2025). This yields a net present value of $251.53 million for the PSVT approval. In addition, the company is then due to receive the $75 million royalty payment from RTW Investments in addition to their live cash net of debt of $15mn. This yields a capitalisation of $341.53 mn and an approval case target price of $5.17. If the recently indicated “rational pricing” paradigm (lower bound of $500) is used then the post-approval price target using identical assumptions grows to $62.74. The $500 price point case is denoted CASE 2 in the attached model whilst the base case is denoted CASE 1.

rNPV and implied probability of approval

The risk adjusted net present value formula for this stage can be given as

Where NPV_PSVT denotes the per share value of the PSVT approval indication ($251.53/ 66mn shares) , p denotes the probability of approval and C.B denotes the cash basis (net of debt) for Milestone. Milestone’s live cash (net of debt) can be estimated at around $15 mn. Relative to 66mn shares, this yields a cash basis of approximately $0.22 / share. Paired with the current share price of $1.90 (as of close on the date of publication, the implied probability of regulatory approval is 33.81%. We find that this probability is not commensurate with the quality of data that Milestone has produced across their several Phase 3 trials with strong enrollment, strong safety and good efficacy results.

Case 3: Patient numbers based on Go et al. (2018) and MESA

Whilst there is a strong case to be made in modelling with the Rehorn et al prevalence and incidence estimates, it should be noted that this is the most sensitive forecasting decision. If the 570,000 , 89,000 figures are used then the value of the PSVT approval is negative and a $70 price point is not possible. This is likely part of the decision that was made to raise the intended price level to $500. In Case 3 we consider a $500 price point with these lower figures. This yields a post-approval price target of $15.37 and an implied probability of approval of 11.05%. Hence, the only situation in which Milestone is not undervalued is if the $500 price point meets significant pushback from payers and the patient numbers do not live up to the more recent, Milestone-funded market research.

Note about conservative estimation

This model does not account for the potential value of the adjacent Atrial Fibrillation (AFib) indication program for PSVT. Given etripamil’s likely approval for PSVT and its continued strong performance in a Phase 3 AFib trial, its chances of approval for AFib—a more prevalent and higher-risk, and hence more valuable condition—appear strong. The non-zero value of this program enhances the margin of safety in our Milestone target price. All assumptions are based on the midpoint of guidance and estimates. The projection that R&D expenditure will decrease to $5M post-approval aligns with the principle that financing and investment decisions are made independently. Since this model focuses on the value of the PSVT indication, it does not factor in potential ongoing R&D investments in the AFib indication. The company is able to make the financing decision for the adjacent AFib indication separately upon approval for the PSVT indication.

Additionally, we do not consider markets outside of the US. Upon US approval, Milestone is likely to seek EMA approval, which will add to the addressable patient population. In addition, Milestone is eligible to receive up to $107.5 million in milestone payments and royalties on future sales of etripamil in Greater China, subject to successful approval and commercialisation in China - overseen by Milestone’s China partner, Corxel, a subsidiary of RTW Investments.

Conclusion

Given the extensive safety and efficacy data from trials, we believe the probability of approval is significantly higher than the highest implied probability of approval of 33.81%. Therefore, we initiate a "STRONG BUY" recommendation alongside a LONG position in the company.

The market's low implied probability of approval may stem from the company’s previous refusal to file, causing it to be overlooked. Alternatively, investors may anticipate commercialization challenges, such as resistance to a $70 per episode price point due to the availability of less effective generic treatments. Another possibility is skepticism about the true size of the PSVT market, with investors questioning Milestone Pharmaceuticals’ prevalence and incidence estimates.

However, we believe the 1M+ prevalence estimate is accurate and that the drug's pricing aligns with its value proposition. Given strong potential demand from both patients and payers, we expect a smooth commercialization pathway. Additionally this analysis is geared to be sufficiently conservative, not considering the value of the less mature A. Fib. pipeline, which will be covered in subsequent research and updates.

Editor’s note

With an understanding that nine out of ten companies in our target universe will fail, we are always excited when we identify a company that meets our stringent STRONG BUY criteria. Such a company must have an outstanding and approvable dataset, demonstrating unquestionable safety and efficacy, as well as a compelling value proposition for both payers and patients.

Milestone Pharmaceuticals is one such company, currently overlooked and undervalued, despite its potential for a significant upside. Its lead asset, etripamil, has a robust clinical dataset supported by multiple well-powered Phase 3 trials, demonstrating rapid efficacy, a strong safety profile, and superiority over existing acute treatment options. I hope that our thesis highlights that etripamil could fundamentally reshape the treatment paradigm.

Despite this, Milestone trades at a valuation close to its cash basis, with little value assigned to its pipeline. This discrepancy is likely due to historical setbacks, including a previous refusal-to-file decision which has deterred many. However, as the regulatory decision date approaches, we believe the market’s implied probability of approval—significantly lower than what the data warrants—is unjustifiably pessimistic. Given Milestone’s high-quality dataset, rigorous trial execution, and the urgent need for better PSVT treatments, we see a highly favourable risk-reward profile at the current valuation.

Fedor Kolchin

Director of Financial Research, Operations

Disclaimer:

Excidium Research and its affiliates currently maintain a long position in Milestone Pharmaceuticals. This report reflects our independent analysis and opinion, but readers should be aware that our financial interest in the company may create an inherent bias. While we strive to provide objective and well-researched insights, we encourage investors to conduct their own due diligence and consider multiple perspectives before making investment decisions.

This report is not investment advice and should not be relied upon as such. It is intended for informational and educational purposes only. Investing in biotechnology and pharmaceutical companies involves significant risk, including but not limited to clinical trial failures, regulatory setbacks, commercialization challenges, and market fluctuations.

It is important to us that you trust our work. To ensure a level of verifiability, each publication will come with a downloadable timestamp.

To check when we published a certain opinion follow the instructions:

Download the .ots file and the original pdf. You can check that the pdf contains the same content as the article.

Follow the link to opentimestamps.org

Upload the .ots file in the section titles “Stamp & Verify”

Upload the original pdf file when prompted

Wait a few moments until the timestamp is confirmed