SELLAS Life Sciences Group

Excidium initiates a SELL rating on SELLAS Life Sciences (NASDAQ:SLS).

26 Jan.

SELLAS has a poor financial position which will not sustain operations necessary to complete its current trials, file an NDA and wait until the PDUFA.

SELLAS is likely to conduct a serious of seriously dilutive capital raises to raise cash to sustain operations.

SELLAS has a history of conducting very dilutive capital raises.

Upwards movements are limited by dilutive warrants exercisable at price levels above $1.20

Galinpepimut-s (GPS) is unlikely to meet the approval criteria at this time due to the low number of participants in clinical trials

The mechanism of action of GPS has been investigated previously, and is not effective.

SELLAS Life Sciences (NASDAQ:SLS) is a clinical stage pharmaceutical company developing oncology drugs. It’s lead candidate is galinpepimut-s for acute myeloid leukemia (AML) and the company has no other price-relevant late stage candidates. Galinpepipmut-S has had three AML trials - NCT01266083 (phase 2 on CR1), NCT00665002 (phase 2 on CR2) and NCT01266083 REGAL (phase 3 on CR2).

GPS is said to be a multivalent heteroclitic Wilm’s tumour 1 (WT1) peptide vaccine. WT1 is a zinc finger protein involved in regulating cellular growth and differentiation. It is overexpressed in cancers such as Acute Leukaemias due to mutations or dysregulations leading to neoplastic cell growth. The overexpression of WT1 leads to its appearance on leukaemic cell membranes as an antigen, making it a useful target for cancer therapies. GPS contains synthetic WT1 peptides which are small fragments of the total WT1 protein, these proteins are taken to be antigens by our immune system leading to the typical T-cell cascade and the generation of memory T cells.

Taking a look at the Phase 2 GPS study, NCT01266083 for CR1 AML

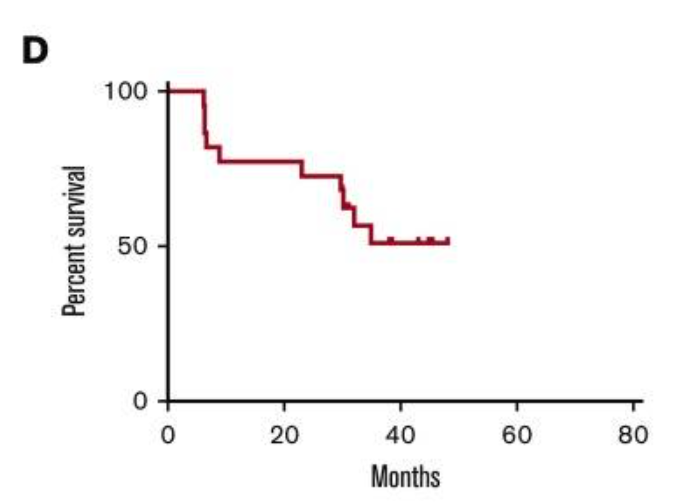

This was an open-label, single-arm study of GPS on patients in CR1. Endpoints selected were ‘to assess the safety’ and overall survival (OS) at 3 years, with a pre-specified efficacy threshold of 34%. Enrollment was 22, which makes quite an immature dataset. Cancer vaccines are a rare target for large studies, especially AML studies. However, a comparable Phase 2 studies of OCV-501 NCT01961882 had an enrolment of 134 (with only CR1 AML patients eligible compared to ALL and AML patients eligible for SELLAS’ Phase 2) . Moreover, the absence of placebo for GPS makes efficacy evaluation difficult. The trial did reach its primary endpoint, with OS at 3 years coming in at 47%, above 34%. No p value has been given that I am able to locate. Without a clear p value, it is unlikely that this is a statistically significant result given the magnitude of the outperformance above pre-specified threshold. The absence of placebo is clear here - a single curve on a chart is pretty useless in terms of assessing efficacy.

Fig 1: percent overall survival from NCT01266083

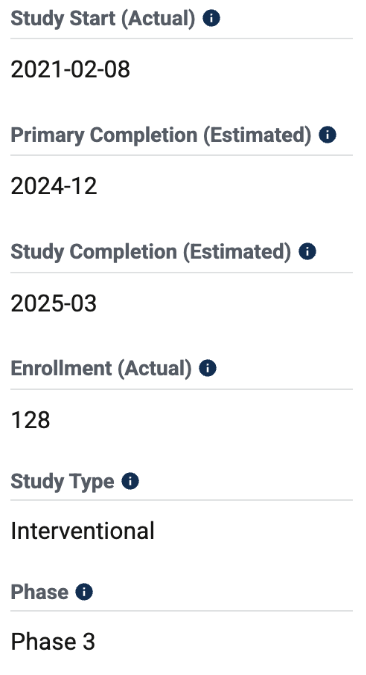

Taking a look at the Phase 3 - NCT04229979 (REGAL)

This study is compared with the Best Available Treatment (BAT) for AML in the second remission of AML. It should be noted that AML tends to worsen on remission as the cancerous cells develop resistance to many traditional treatment methodologies such as chemotherapy.

An enrollment of 128 is once again disappointing from SELLAS given that this is a Phase 3 clinical trial. The primary objective of the trial is to compare the efficacy of GPS to the Investigator's choice of BAT on OS in subjects with AML who are in CR2/CRp2. The study is not yet completed, however, their primary seems like a fair endpoint despite the underwhelming enrollment.

Results have not yet been posted on this study.

Fig 2: REGAL Summary table -clinicaltrials.gov

Finding precedent in the OCV-501 trial.

Another peptide vaccine targeting the Wilms' tumor 1 (WT1) antigen, OCV-501 has some useful clinical trials (NCT01961882) that we can take a look at, given the similarity of the MoA. A notable difference is that the OCV-501 peptide trial was done in patients with 1 complete remission whereas GSP is done in patients with 2 complete remissions. This means that sls are facing a greater challenge of treatment given that leukaemia tends to worsen in severity with each remission. Additionally, OCV-501 was compared to placebo whereas SLS are drawing a comparison to the BAT. Altogether, this sets a higher bar of efficacy in the REGAL trial than NCT01961882 - a bar of efficacy which was not mot by OCV-501; NCT01961882 failed to find statistical significance (p=0.74) in 5 year disease-free survival rate

Financial Position

Looking at the company more broadly, SELLAS’ financial position and past capital raises should be a concern for potential investors. As of their 10-Q dated Sep. 30 2024, they had Cash & Equivalents of $21mn. At the same time, they have roughly $10.6mn in current liabilities and they burned $7.329mn during that quarter. Assuming SELLAS continues to round down operations to preserve cash (which is the opposite of what they will have to be doing upon the completion of their REGAL trials and preparation to file the NDA) to reduce cash burn by 20%, they are scheduled to run out of cash by Q3 2025. When a decrease in current liabilities of $4mn, caused by some payables and accruals maturing, is factored in they are scheduled to run out of cash by the end of Q2 2025. Whichever way you look at it, SELLAS doe not have the cash runway to last until commercialisation. There is also no valid commercialisation partner in the picture, so that is not a relief for SELLAS either.

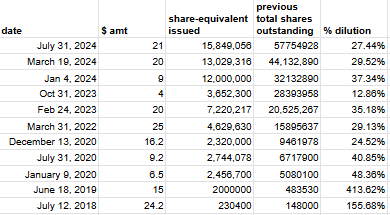

This leaves a dilutive capital raise or a debt issuance as the two alternatives to bankruptcy for SELLAS. Looking at SELLAS’ SEC filings, it becomes clear that the company has done a large number of capital raises over the last five or so years. This can be summarised in Fig.3 :

Fig. 3 A table showing dilutive capital raises run by Sellas. More info can be found on the linked spreadsheet

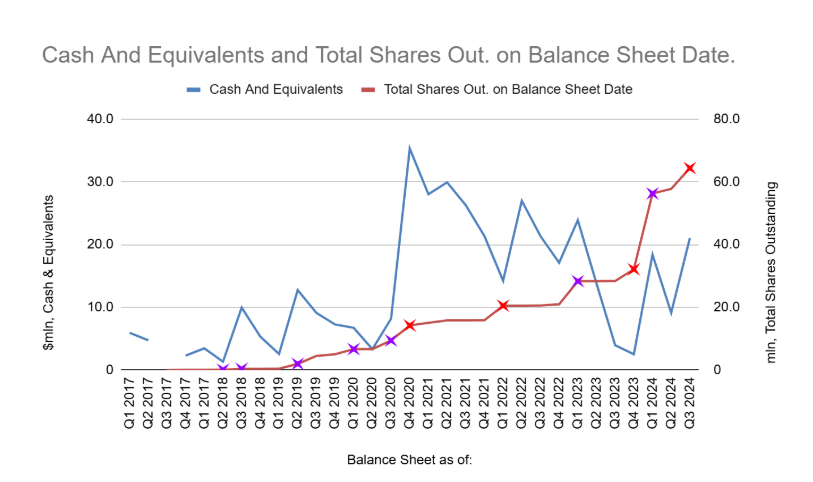

These capital raises can be plotted against SELLAS’ cash to establish a pattern of behaviour in Fig. 4 As exemplified by Q2 2018, Q2 2019, Q1+Q3 2020 and Q3+Q4 2023, whenever cash falls to around $5 mn, SELLAS runs a dilutive capital raise which dilutes equity by an average of 31.7%. Investors may choose to stay away from the company with the understanding that SELLAS is due to reach this financial position in the next two quarters.

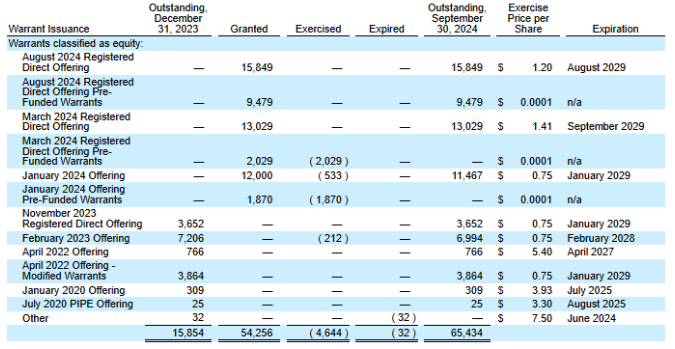

Additionally, investors should beware that upside is really limited by a large number of dilutive warrants hanging at $1.20 and $1.40 price levels. Almost each time that SELLAS has sold stock, they have sold an equivalent number of warrants as part of a package deal to sweeten the capital raise. This has resulted, especially following the 2024 offerings, in a large number of outstanding warrants, summarised in Fig. 5 . If SELLAS was to rally to the 1.20 pricepoint, 15.8mn warrants become dilutive and a further 13m at $1.40. Warrants would be exercised by the investors and will create headwinds for the price in any upside situation. This provides a kind of ‘natural hedge’ to any short sellers. Overall there are 65mn warrants outstanding, with a significant proportion of those being in the money. Considering SELLAS currently has around 70mn shares outstanding, this is a deeply uncomfortable situation for investors.

[Fig. 4] Cash & Equivalents vs Total Shares Outstanding on balance sheet date. Cross represents a dilutive capital raise. Each purple cross represents a dilution by more than 30%.

Fig. 5, taken from SELLAS’ latest 10-Q, summarising outstanding warrants.

It may be worthwhile to note that the CFO responsible for this strategy, John Burns was previously Vice President of Finance and Corporate Controller, as stated on his LinkedIn at Galena Biopharma, a company beset with fraud lawsuits, that SELLAS had acquired as part of a reverse merger. Additionally, John Burns began his career at Sellas’ current auditor, Moss Adams LLP - which also served as auditor for Galena Therapeutics during their frauds.

The merger with Galena is a pretty strange one. SELLAS gave 32.5% of the joint entity to the shareholders of Galena, which had one already-failed candidate (another peptide vaccine), nelipepimut-s, with no other late stage candidates. Galena also has negative current net assets and net assets close to zero at the time of the acquisition. Despite this, SELLAS recognised $ $17.6 mn of intangibles, a completely unjustified valuation, as a result of this transaction. To sum up, SELLAS acquired Galena to go public, inheriting lawsuits, an unattractive balance sheet and an immunology platform which produced a failed peptide vaccine, recognising $17.6 mn of intangibles that proved to be worthless. This was done in place of an IPO, wherein SELLAS would have been able to actually raise cash instead of forfeiting it.

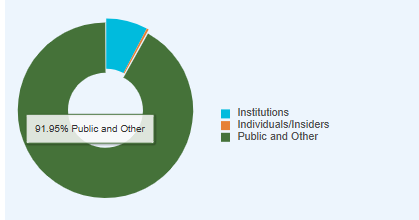

Fig. 6 SELLAS Life Sciences public ownership breakdown

SELLAS has a hefty retail ownership of 91.9% - perhaps an indicator that institutional interest in SELLAS is lacking at this point in time. This could be part of the reason why SELLAS has had to dilute so hard every time they raised capital - there are few takers on the street for their shares, creating these unfavourable terms.

It is important to us that you trust our work. To ensure a level of verifiability, each publication will come with a downloadable timestamp.

To check when we published a certain opinion follow the instructions:

Download the .ots file and the original pdf. You can check that the pdf contains the same content as the article.

Follow the link to opentimestamps.org

Upload the .ots file in the section titles “Stamp & Verify”

Upload the original pdf file when prompted

Wait a few moments until the timestamp is confirmed

CEO Jumps on the AI x Trump Bandwagon on Fox News ahead of funding round.

Fedor Kolchin

$SLS - SELLAS Life Sciences, update

27 Jan

SELLAS Life Sciences rallied by almost 39.60 % during trading today. Whilst we have a beneficial short position in SELLAS, I was very excited by this development and feel that you should share in my excitement too.

Today’s impressive rally was caused by Angelos Stergiou’s appearance on Fox News. Stergiou hopped on the AI bandwagon, claiming that SELLAS is a pioneer in AI, and touted the role that AI played in the development of GPS. This move comes amidst particular excitement, particularly on Fox News about the potential of AI in curing cancer, as highlighted by Donald Trump during the Stargate press conference on 21 Jan. To remind readers, Galinpepimut-s has been in development at least since 2017 and SELLAS has very little to do with AI - no matter how hard the CEO tries to ‘pump’ the share price on Fox News. In addition, Maxim Group’s Jason McCarthy reiterated his BUY rating on SELLAS Life Sciences. These two factors are likely to have introduced many new investors to SELLAS, which is likely to be driving most of the price action today.

The timing of these two events makes me think that an RDO may be coming sooner rather than later. In our previous article, I highlighted that the company is running low on cash and is due for bankruptcy in mid 2025 - forcing them to seek additional public financing as they have done many times in the past when their cash is low. This creates strong incentive for management and affiliated parties to increase the share price to make sure that the RDO happens on favourable terms. Whilst Stergio’s role here is obvious, perhaps investors need reminding that Maxim Group has acted as a placement agent in the overwhelming majority of SELLAS RDO’s as of late, and stand to benefit massively from a strong share price during the upcoming offering. Jason McCarthy also has an unfortunate 29% success rate and an unimpressive average return per rating of -14.10%, making his BUY rating on SELLAS a rather bullish indicator.

Update #1 Timestamp

It is important to us that you trust our work. To ensure a level of verifiability, each publication will come with a downloadable timestamp.

To check when we published a certain opinion follow the instructions:

Download the .ots file and the original pdf. You can check that the pdf contains the same content as the article.

Follow the link to opentimestamps.org

Upload the .ots file in the section titles “Stamp & Verify”

Upload the original pdf file when prompted

Wait a few moments until the timestamp is confirmed